Today I'm going to be looking into the Dow 30 Index. This index is home to some of the biggest and most valuable companies in the world.

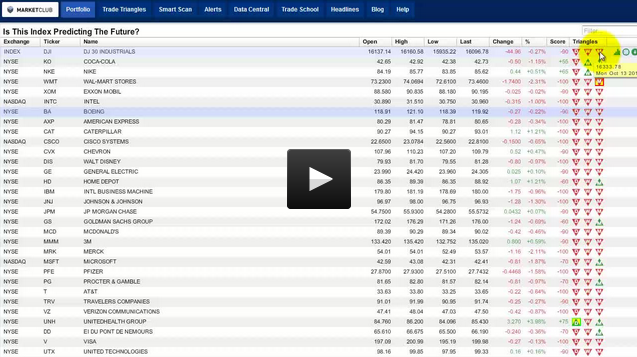

Using our Trade Triangle technology, you can quickly see that out of the 30 stocks that make up this index, just three stocks remain in a bullish trend. Out of the remaining 27 stocks, 6 are in a trading range and 21 stocks are in downtrends.

With two-thirds of the stocks in this important index in downtrends, this index is casting a shadow over the general economy.

The 3 stocks that remain in uptrends are rather mundane companies that have been around a long time.

Here are the 3 stocks that are still bullish and I will be looking at in today's video:

The Coca-Cola Company (NYSE:KO) founded in 1892

Nike, Inc. (NYSE:NKE) founded in 1964

Wal-Mart Stores, Inc. (NYSE:WMT) founded in 1962

These are not the new kids on the block. These stocks have been around for a minimum of 50 years and still represent great value in the marketplace.

I will also be looking at some of the dogs of the Dow. These stocks are in clear downtrends and I will analyze just how far they can go on the downside.

Those stocks are:

Exxon Mobil Corporation (NYSE:XOM) founded in 1999

Intel Corporation (NASDAQ:INTC) founded in 1968

The Boeing Company (NYSE:BA) founded in 1916

If two-thirds of the DOW is in a strong downtrend and only 3 stocks are in uptrends, is that enough to reverse the 21 stocks that are in downtrends? Conversely, will the 3 stocks that are in uptrends get dragged into downtrends?

Have a question for us? You can leave a comment or a question below.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

Dear Adam,

Compliments for Good analytic approach.

I would like to share some my personal observations like,:-

1- While analyzing any index, some components company may out perform then overall index movement, however that is due to individual business cycle, and it is also quite possible that today's gainer stocks may also turned loser in later stage, and even if they continue bull run, effects of other stock's loss can wipe out its gain effects, so it should not take important or concerned issue for considering overall trend.

2- Equation of Over all percentage wise gain and loss is more important rather then numbers of Index component gainers or losers, so if over all gain is greater then over all loss or viz.viz, this study is more relevant matter, and it reflect more precised picture.

3- Over all medium and long term trend analysis is more important to predict future possibilities, and as per medium and long term views, DOW has broke some crucial support levels, and proceeding towards to break even some more support levels of next lower points