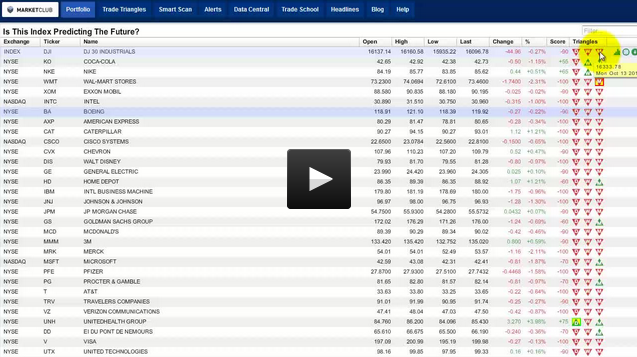

Today I'm going to be looking into the Dow 30 Index. This index is home to some of the biggest and most valuable companies in the world.

Using our Trade Triangle technology, you can quickly see that out of the 30 stocks that make up this index, just three stocks remain in a bullish trend. Out of the remaining 27 stocks, 6 are in a trading range and 21 stocks are in downtrends.

With two-thirds of the stocks in this important index in downtrends, this index is casting a shadow over the general economy.

The 3 stocks that remain in uptrends are rather mundane companies that have been around a long time.

Here are the 3 stocks that are still bullish and I will be looking at in today's video: Continue reading "Is This Index Predicting The Future?"

Today I'd like everyone to welcome Larry Levin. Larry is a very well known trader and is often featured on CNBC and other financial television shows, and today he's going to be talking about one of the hardest things we as traders must do - pull the trigger! He's got some excellent advice that can be applied to all levels of traders. Please enjoy the article, comment below, and visit

Today I'd like everyone to welcome Larry Levin. Larry is a very well known trader and is often featured on CNBC and other financial television shows, and today he's going to be talking about one of the hardest things we as traders must do - pull the trigger! He's got some excellent advice that can be applied to all levels of traders. Please enjoy the article, comment below, and visit