It's no secret – it's a tough market out there. Oil prices are at record lows, the US dollar remains stubbornly strong, and now the Fed has all but admitted that the economy is weaker than expected and we might need to start preparing for negative rates.

In this kind of environment, smaller companies can often slip through the volatility. They can ride the waves of uncertainty and ignore macroeconomic hardships that plague their larger competitors making the smaller one an unlikely winner. If that stock is an industry which is trending higher, that's even better.

One stock in the communications sector is slipping through the noise and could be a huge opportunity for investors. The communications sector is widely viewed as an industry undergoing a rising tide, which as most investors know means it lifts all ships within that industry.

The big push with the IoT (Internet of Things) and wireless technology is expected to inject high growth into the communications sector over the next decade. Moody's Investor Service estimated 2016 industry revenues to grow by 3% to 4% while margins EBITDA for wireless segments to increase 1%. The sector is also cash rich making it an attractive playground for companies looking for a merger or acquisition.

A Micro-Cap Communications Company Posting Impressive Numbers

ClearOne, Inc. (NASDAQ:CLRO) is a $113 million micro-cap communications company that provides voice and visual communication solutions globally. The company has carved out a profitable niche in the industry with few direct competitors of comparable size and is growing at an astounding rate.

The company reported an earnings beat recently of $0.30 per share versus the $0.26 per share expected by analysts. Year-over-year revenue growth is in excess of 70% while its operating margins are a healthy 17.6%. Growth estimates have been going up as well. EPS estimates for this quarter have been raised from $0.22 per share to $0.24 per share and full year estimates went up from $0.80 per share to $0.86 per share.

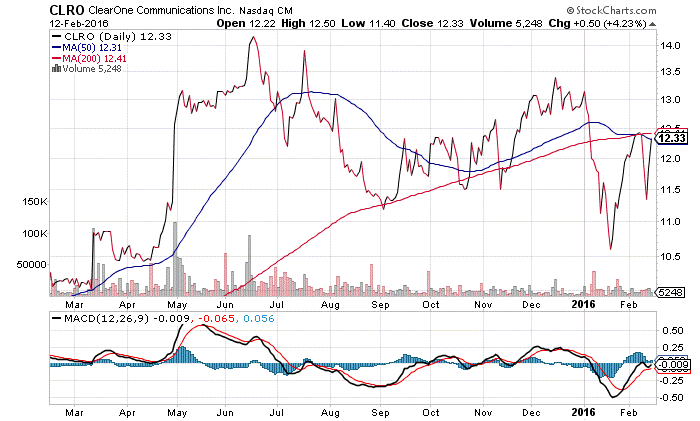

ClearOne's chart shows us the beginnings of a great momentum story.

Chart courtesy of StockCharts.com

The stock is up over 21% year-to-date while the 50-day moving average and the 200-day moving average are trending together. The MACD has greatly improved and is threatening to send off a bullish positive signal telling us that the stock is still as of yet unknown as a momentum growth play.

The fundamentals look good too. The stock trades at only 11.6 times earnings compared to the industry average of 21. The long-term EPS growth rate of the stock is high at more than 27% – well above the industry average of 4.6%. The company carries no debt to speak of either making it agile in the face of economic hardship while also being attractive to possible mergers or acquisitions.

The stock in unique in the sense that it carries a small dividend yield of 1.6% making it stand out in the realm of micro-cap stocks. Combined with the company's lack of debt, it makes the stock appealing to value and growth investors alike.

Given the newly raised full year EPS growth estimates and P/E ratio, the stock should be fairly valued at around $14.50. That gives investors a potential profit of 17.50%.

Check back to see my next post!

Best,

Daniel Cross

INO.com Contributor - Equities

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.