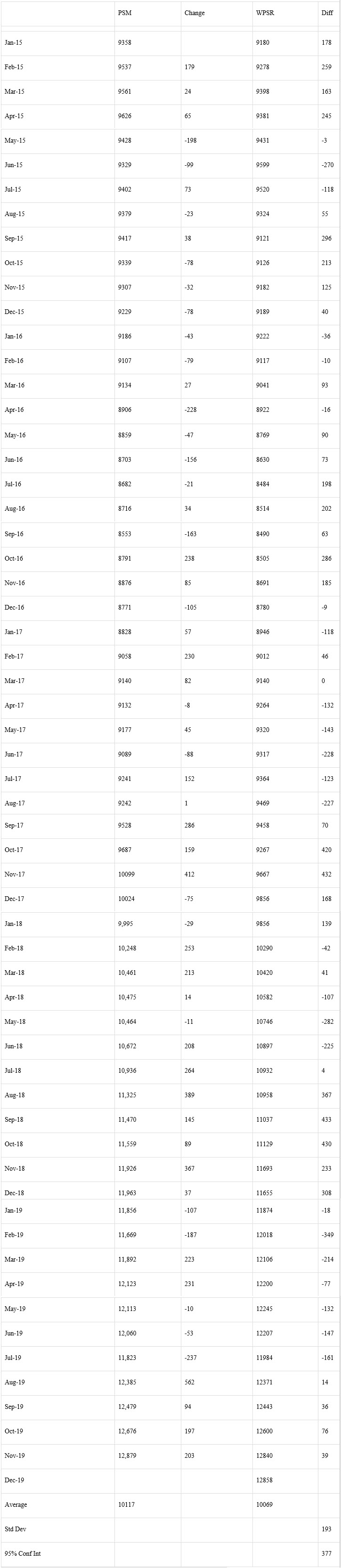

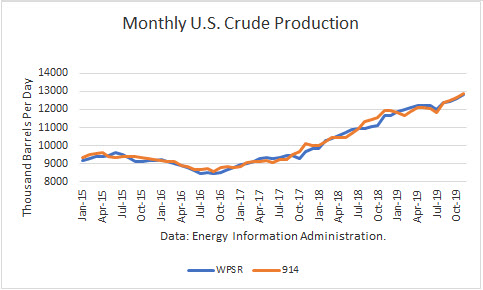

The Energy Information Administration reported that November crude oil production averaged 12.879 million barrels per day (mmbd), up 203,000 b/d from October. In addition, the October estimate was revised 21,000 b/d higher, and so the total gain was 224,000 b/d from the prior estimate.

The Gulf of Mexico rose by 91,000 b/d to 1.995 million barrels per day. Texas production reached a new high of 5.329 mmbd, up 65,000 b/d from October. And New Mexico’s production gained 59,000 b/d to 1.063 million barrels per day.

Plains All American Pipeline LP’s (PAA) Cactus ll pipeline was expected to ship at full capacity, 670,000 b/d, beginning in September. EPIC Midstream’s crude oil pipeline began shipping 400,000 b/d. It is designed to ship 440,000 b/d from the Permian and another 150,000 b/d from the Eagle Ford.

Phillips 66 Partner’s Gray Oak pipeline is expected to ship an additional 900,000 b/d. It began shipments and is expected to be in full service by the end of the first quarter of 2020.

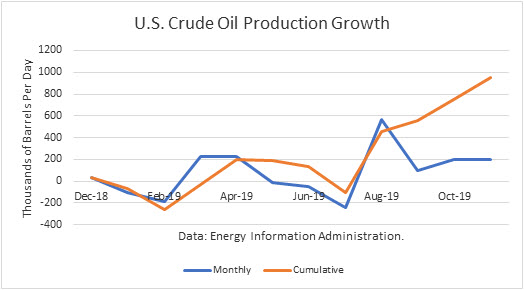

The gains from last December have amounted 953,000 b/d. And this number only includes crude oil. Other supplies (liquids) that are part of the petroleum supply add to that. For November, that additional gain is about 500,000 b/d.

The EIA-914 Petroleum Supply Monthly (PSM) figure was 39,000 b/d higher than the weekly data reported by EIA in the Weekly Petroleum Supply Report (WPSR), averaged over the month, of 12.840 mmbd.

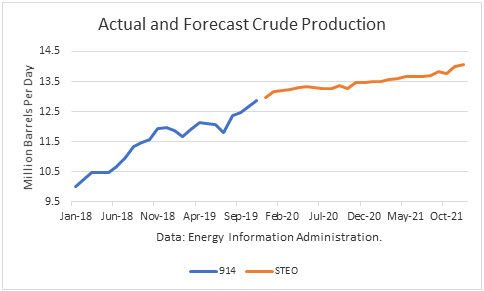

The November figure was about 17,000 b/d higher than 12.860 mmbd estimate for that month in the January Short-Term Outlook. And so that implies no need for a “rebenchmarking” to EIA’s model in future production levels at this time since the difference was not large enough to warrant it.

The EIA is projecting that 2019 crude production will exit the year at 12.97 mmbd. For 2020, the EIA is projecting an exit at 13.48 mmbd. And for 2021, it projects an exit at 14.08 mmbd.

Conclusions

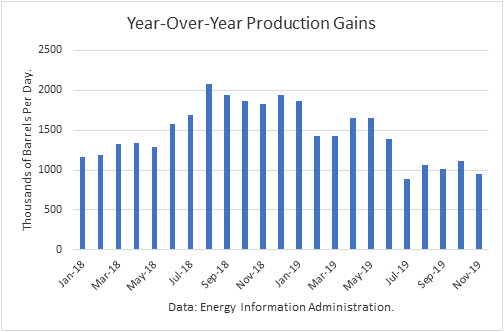

The strong gain in November adds to the rises in August through October, refuting the theory that U.S. crude production gains have slowed substantially. And gains in Texas owing to the opening of the three pipelines are only beginning to contribute the rise that I expected to see, given production plus transportation costs have been effectively lowered, taking into account delivery costs to the U.S. Gulf. In total crude plus liquids grew by about 1.45 million barrels per day over the 12 months ending November.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Could you give me the name of the company who recently discover big oil deposit at Permian Texas?

Thank you in advance, Mark Szukala