The internet is still one of the most revolutionary things invented. The new level of communication and coordination it gives us is just amazing. Hedge funds could not imagine a sudden coordinated attack that started as a post on Reddit could impact them so hard. The next market in their crosshairs? Silver!

The GameStop frenzy just let the dogs out. Lately, the retail investors from the famous Reddit chat Wallstreetbets started looking towards the iShares Silver Trust ETF (SLV) as they are looking forward to profiting from the same strategy of short squeeze earlier mastered on GameStop shares. They chose SLV ETF because its shares are backed with physical silver.

I prepared two silver charts to show you how the retail market force changed the structure and its outcomes.

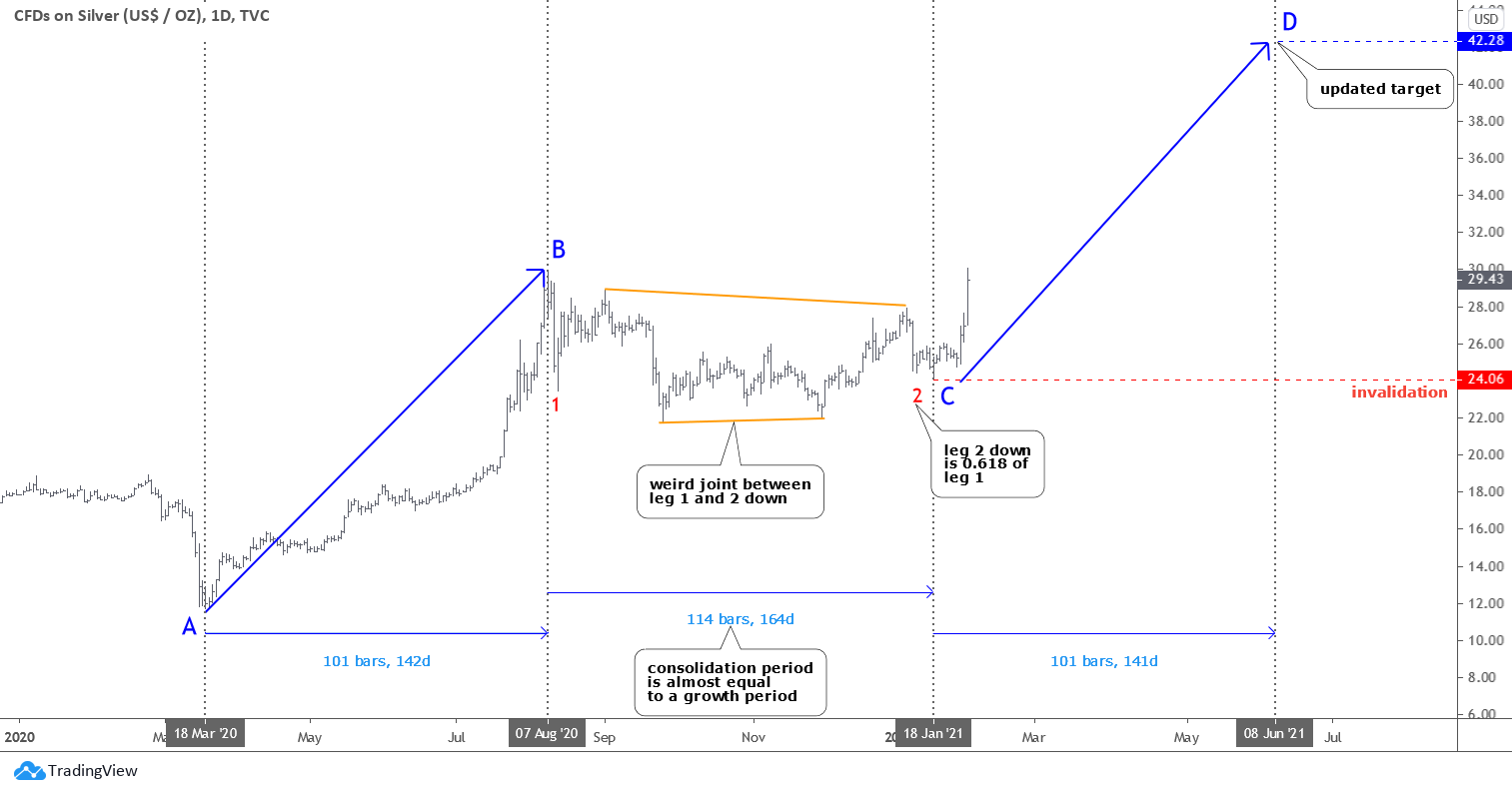

There is an optimistic scenario depicted in the chart above. It implies the completion of the entire corrective structure. The red leg 2 down is considered to be done as it traveled only 0.618 of the red leg 1 distance. As you may remember, it is the Fibonacci ratio. The joint between legs 1 and 2 looks weird but is yet possible.

The endpoint of red leg 2 at the same time is the start point of the new CD segment to the upside. I updated the target for it as the C point could have been established higher than expected at $24.06. If the CD part travels the distance of the AB segment, then it could hit the $42.28. The potential profit could exceed 40%.

I want to draw your attention to the time stickers underneath the price graph. We can see that the AB move up took 101 bars to emerge; the BC part of consolidation consumed 114 bars or an almost equal amount of time. I wanted to show you how long the consolidation phase could last and how tricky its structure. The CD part could be sharper, but I conservatively put the same period as it took the AB segment, and the completion falls at the start of the summer. Let’s see how it goes.

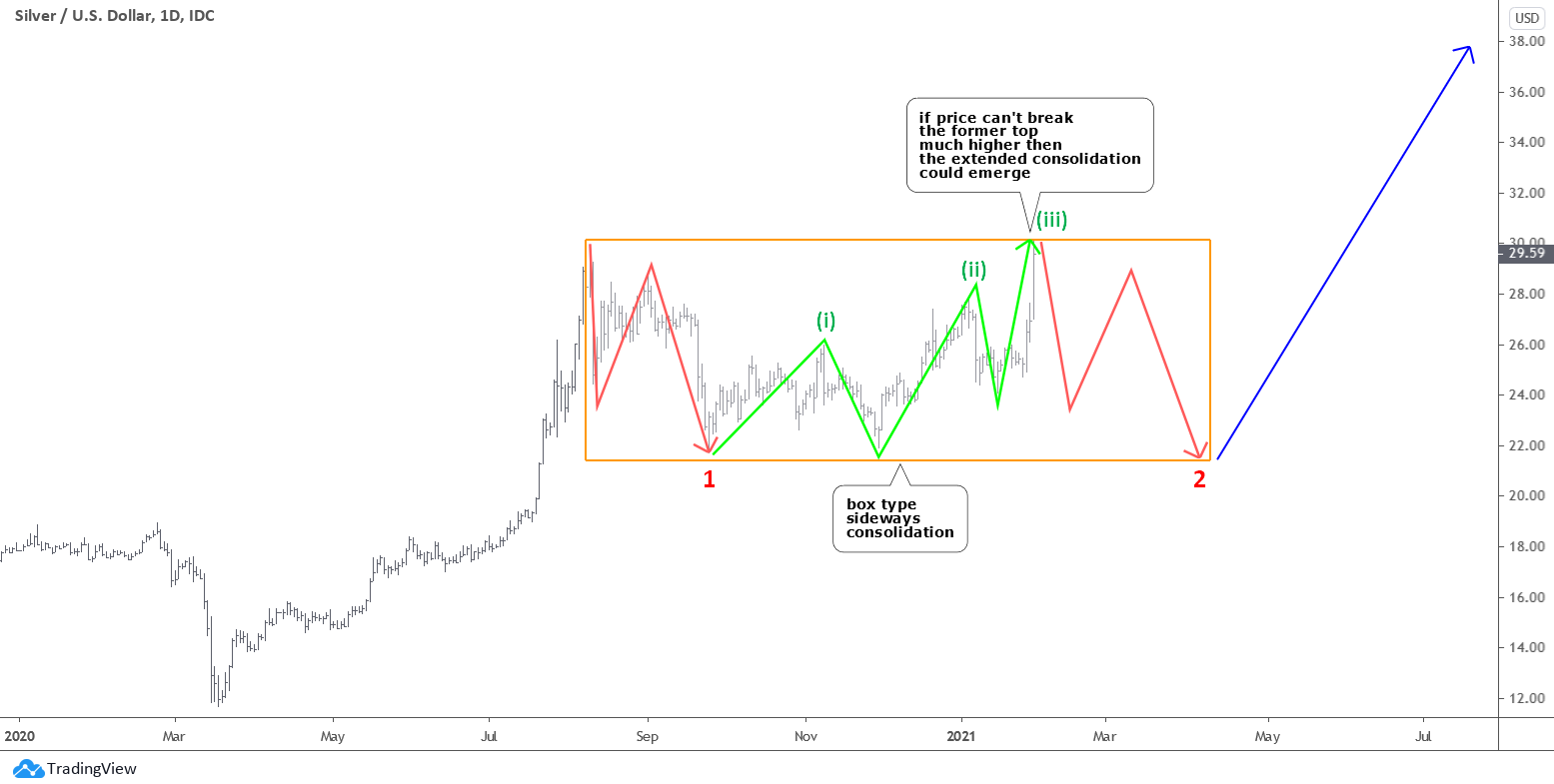

Not all agree that this retail attack could be as successful as GameStop (GME). In this case, another structure could unfold in the chart below.

In case of a failure to the upside, there is a risk of extended consolidation to play out. If the price can’t break the former top with a visible margin, then the price could reverse to the downside to build another large leg down to retest the valley of $21.67 established in September 2020.

It could be a box type sideways consolidation, and I added the zigzags to highlight the internal structure. The left zigzag down was the first leg 1. The following green zigzag up consists of three legs, and it links the red leg 1 and the red leg 2 to the downside. After the entire structure gets completed, the move up could resume.

Here is a bonus chart for you if you are bullish on silver.

This stock has the best valuation ratio in the industry, with a P/E of 28. It is the Silvercorp Metals Inc. (SVM). This is a Canada-based mining company that acquires, explores, and develops mineral properties in China. The company produces silver, lead, and zinc metals. Let’s look at the chart below.

This stock has a wonderful chart structure. Here we have that red leg 3 down, which tagged the former valley of the red leg 2 down to complete the entire corrective structure. We missed that structure in the silver chart.

The price is already moving to the upside, looking towards a breakup of the red trend channel’s resistance around $7.30. The chart shows that the pre-market price of $8.22 is already above that barrier; let’s see how the market opens.

The RSI sub-chart also shows a textbook breakup as the Bullish Divergence plays out there. This is a good sign.

The target is located at the ambitious $13.00 where the CD part will travel an equal distance of the AB segment. The gain from the Friday close could reach 100%!

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Dear gentlemen,

Let me clarify about the purpose of this post. There’s nothing about GameStop trading as I usually cover precious metals.

It was meant to show that silver is in focus as it was favored over gold as I usually show them both in regular Gold & Silver reviews. You can see in the gold chart that there is no such strong move there.

I wish you all a good luck with trading!

Peace, Aibek

Strong words Patrick to probably the best metal technical analyst I have read in 40+ years of investing. Apology be appropriate

Aibek,

Your insightful posts, gave the affirmation I needed to keep accumulating the gold and silver miners. Appreciate pointing out SVM, I've been partial to CDE, up over 40% on the opening. Just had to give them some.

Please I have done so well in the space the last 18 months, you have helped more than enormously. I want to make a donation to charity in your honor.....please please is there a cause you support.

Stay Well

Al

Dear Mr.Levy,

Thank you for a warm feedback.

I am happy to share as INO.com gives me such a good opportunity here on the Blog.

Let you decide whom you are going to support in need. It’s so inspiring!

Take care and have a wonderful 2021 ahead!

Aibek

Thomas is correct that the leaders of the Reddit group who targeted GME are not leading a charge to tackle SLV.

It appears that the issue of silver came up after some Reddit discussions mentioned the extreme short position on First Majestic Silver (AG.)

While going after shorts on some of the silver stocks makes sense, I think the idea of piling into SLV in order to drive the price of silver up may very well have been a diversionary tactic by a hedge fund who wants to dilute the Reddit focus.

That said, I am holding a *ton* of silver stocks and options, and I sold very little today. I believe the party is just getting warned up.

i agree

I am constantly on that forum and saw no posts about SLV. Please point me to a few or even one post advocating SLV as a reference to prove your claim.

Hey Patrick, like you I'm on that forum all the time and SLV was and is all over it, esp yesterday.

https://www.reddit.com/r/wallstreetbets/comments/l6novm/the_real_dd_on_slv_the_worlds_biggest_short/

https://www.reddit.com/r/wallstreetbets/comments/l9tzkv/the_dd_on_slv_updated_131_clarity_on_what_to_buy/?utm_source=share&utm_medium=web2x&context=3

A quick SLV search will result in all kinds of content -

https://www.reddit.com/r/wallstreetbets/search/?q=slv&restrict_sr=1

Or you can just read the new SLV Takeover thread -

https://www.reddit.com/r/SLVTakeOver/

Fake !!!!!!!

No, this is an obvious attempt to get people to sell or not buy $gme. Did you even read the forum?

Diamond hands baby.

Exactly. The whole "WBS has moved to silver" is a complete lie. I checked it this morning and they are still bullish and holding GME.