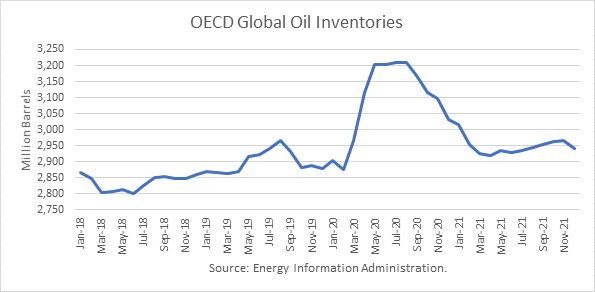

The Energy Information Administration released its Short-Term Energy Outlook for March, and it shows that OECD oil inventories likely peaked at 3.210 billion in July 2020. In February 2021, it estimated stocks dropped by 62 million barrels to end at 2.955 billion, 80 million barrels higher than a year ago.

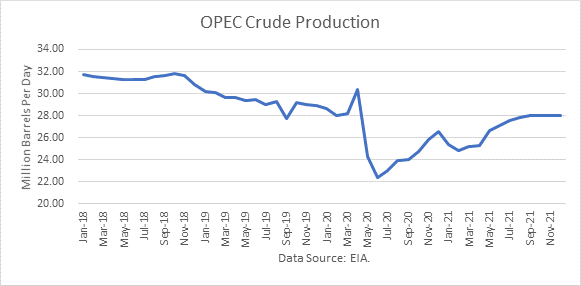

The EIA estimated global oil production at 92.17 million barrels per day (mmbd) for January, compared to global oil consumption of 95.89 mmbd. That implies an undersupply of 3.72 mmb/d, or 104 million barrels for the month. That implies non-OECD stocks dropped by 42 million barrels in addition to the OECD stock draw of 62 million barrels.

For 2021, OECD inventories are now projected to draw by net 91 million barrels to 2.942 billion. For 2022 it forecasts that stocks will draw by 26 million barrels to end the year at 2.949 billion.

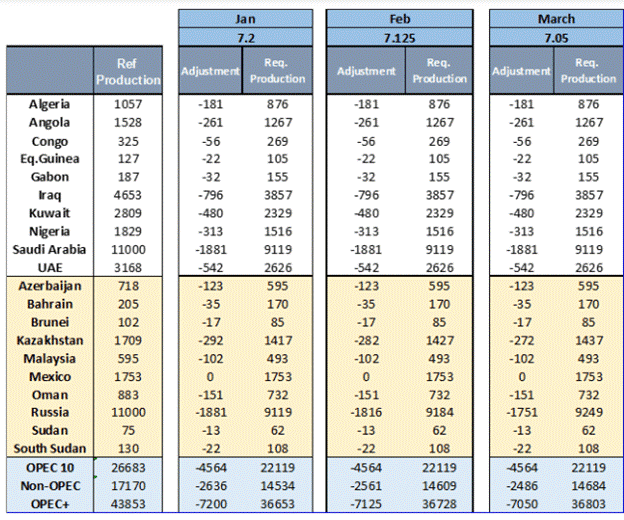

The EIA forecast was made incorporates the OPEC+ decision to cut production and exports. According to OPEC’s press release January 5, 2021:

“The Meeting acknowledged the need to gradually return 2 mb/d to the market, with the pace being determined according to market conditions. It reconfirmed the decision made at the 12th ONOMM to increase production by 0.5 mb/d starting in January 2021, and adjusting the production reduction from 7.7 mb/d to 7.2 mb/d.”

“The adjustments to the production level for February and March 2021 will be implemented as per the distribution detailed in the table below.

On March 4th, OPEC announced:

“The Ministers approved a continuation of the production levels of March for the month of April, with the exception of Russia and Kazakhstan, which will be allowed to increase production by 130 and 20 thousand barrels per day respectively, due to continued seasonal consumption patterns.”

The EIA has assumed the following OPEC production levels for its STEO:

Oil Price Implications

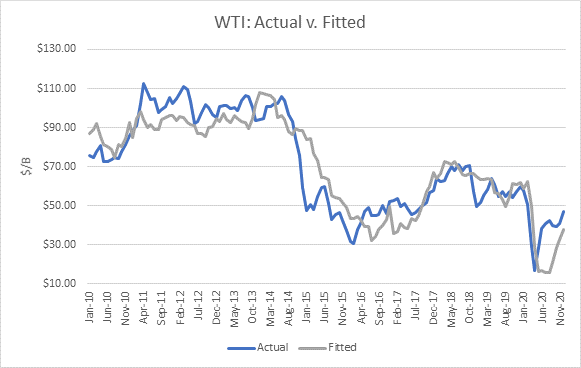

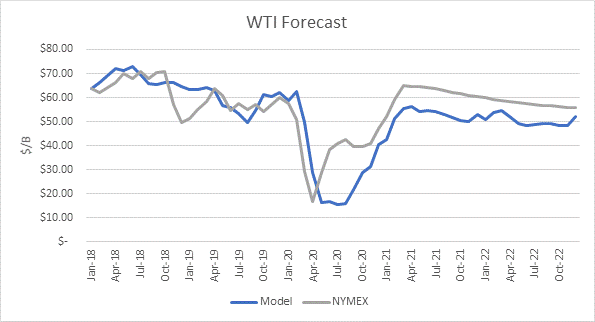

I updated my linear regression between OECD oil inventories and WTI crude oil prices for the period 2010 through 2020. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 82 percent.

I used the model to assess WTI oil prices for the EIA forecast period through 2021 and 2022 and compared the regression equation forecast to actual NYMEX futures prices as of March 10th. The result is that oil futures prices are presently overpriced through the forecast horizon through December 2022.

Uncertainties

April 2020 proved that oil prices can move dramatically based on market expectations and that they can drop far below the model’s valuations, whereas prices in May through February proved that the market factors-in future expectations beyond current inventory levels.

In addition to uncertainty of how deeply and how long the coronavirus will disrupt the U.S. and world oil consumption, another issue is how long OPEC+ will constrain production, knowing that high prices provide incentive to other producers, such as shale, to restore their production.

Another uncertainty is whether the U.S. will lift sanctions on Iran this year while rejoining the Iran nuclear deal. Biden has clearly stated that he wants the U.S. back in the deal. That could put around 2 million barrels a day back into the world market.

Conclusions

Given the recovery in oil prices, it is likely that shale oil will respond by the higher incentives to produce. OPEC appears to be ignoring that factor. OPEC appears to also be ignoring the likely lifting of Iranian sanctions this year.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

I would still like to know where all this electricity is coming from. All this EV talk along with all the innovative and clean ETFs sort of feels like the dot com bust. Maybe the Green New Deal folks will build more hydro-electric plants, maybe more coal mining, no wait, nuclear plants would do it. Maybe hydrogen and sodium will come to the party soon. We get most of our rare earths from China anyway, so maybe we should ask them. Anybody?

The real reason the gas prices are going up at the pumps is that the sheiks realize that as soon as the ev’s dominate, the need for their oil will decrease infinitely! So now is the right time to gouge drivers all over the world before the ev’s hit the road! I don’t know the existing breakdown of dependence on oil at this time and a year from now, but that has to worry the total oil industry!

Excellent point. We are in the transition phase from fossil to electric.Vehicles are the first and most obvious target.Replacement will be transitory and present trading opportunities along the way.