This week we have a stock market forecast for the week of 9/12/21 from our friend Bo Yoder of the Market Forecasting Academy. Be sure to leave a comment and let us know what you think!

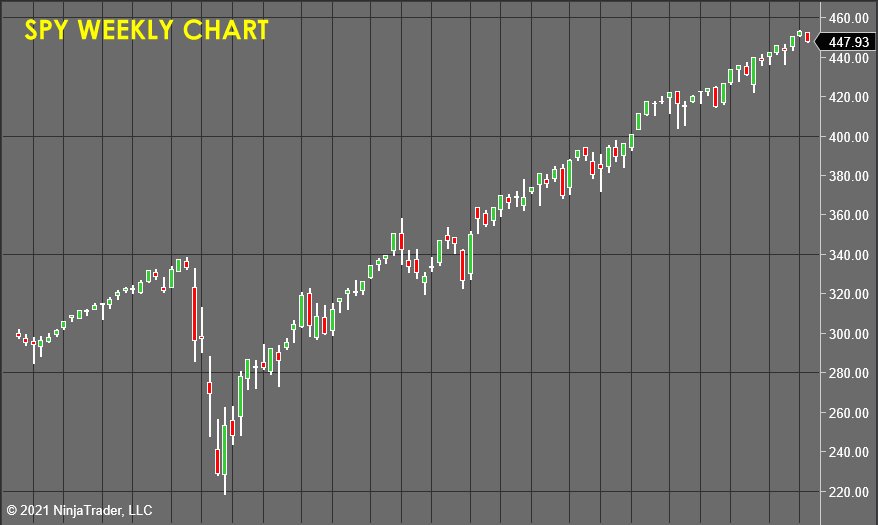

The S&P 500 (SPY)

After all our waiting, the S&P finally turned over and printed a bearish, non-hysterical candle on the weekly chart. So next week’s reaction will tell me a lot. If the bears come out in droves, then we can get confident and aggressive on the bear side, but if we sell off early, then close strong, it would indicate that we remain stuck.

I’m building a watch list of short opportunities, but it would be imprudent to enter now, as there just hasn’t been any actionable data coming out of this market for weeks. However, I’m hopeful that will change in the next 7 days.

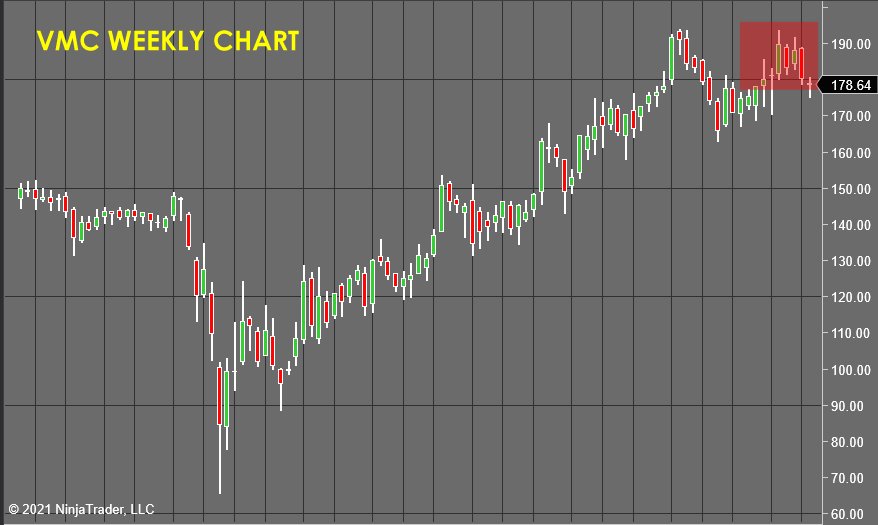

Vulcan Materials Company (VMC)

VMC started out the week with some downside follow-through, then whipsawed back to close out right where we started.

If the market indexes commit to the downside this week, VMC should outperform and put some nice red on that chart.

SPDR Gold Shares (GLD)

Gold is having its first correction since entry. If it falls down near the $165 level, then reverses... it would form an “inverse head and shoulders,” which would be a significant buy signal for this market.

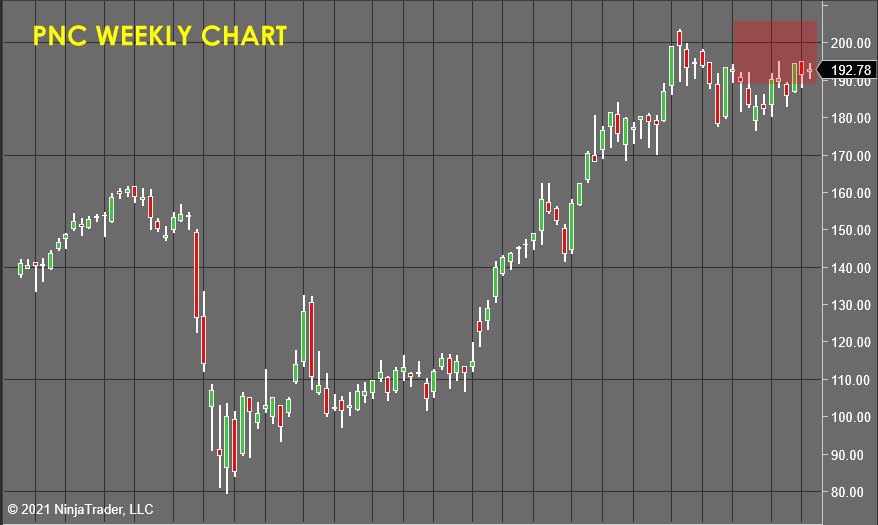

The PNC Financial Services Group, Inc. (PNC)

PNC continues to chop near its highs. If the market indexes go bearish, as I have discussed above, PNC MUST respond quickly and decisively, or I will start to consider scratching this for lackluster response to stimulus.

Today’s Lesson: The Top 5 Reasons Traders Lose Money (Reason #2)

The second biggest “leak” that I see traders allowing to persist in their trading program is...

Reason #2 – Consistently taking profits that do not justify the initial risk

The trader sees a long opportunity in the stock of ABC and buys some shares...

The stop loss for this trade is set $2 lower than entry, and the price rallies nicely about $1 to test a minor area of resistance...

Now the trader’s mind starts working up excuses and reasons to exit RIGHT NOW!

The fear of a wiggle or the trade turning bad...

“You can’t go broke taking a profit” LIE!

Basically, the uncertainty of an active and open position makes the human mind crawl with anxiety. We like to have instant gratification and feedback on our choices, ESPECIALLY when those choices are made in an arena where there is risk and possible negativity.

Here is the problem...

If you take profits that don’t justify the initial risk you assumed, you can create a trade with a NEGATIVE EV!

Imagine that you have a trade with a 50% win rate and a 2 to 1 risk to reward on paper.

The EV for that trade would be .50, and anything more than a 34% win rate would produce a positive EV.

But if you start taking impulsive and emotional profits, you are leaving VAST amounts of money on the table.

If you take $1, having risked $2 on the trade, you would need a 67% win rate to just break even!

Do you see how much those deviations from the plan cost you?

In this example alone, if you bail with a $1 profit, and eventually it goes the full 2 to 1, you just gave away another $1 and could have had double the profit!

This is such a universal problem that I wrote an article on this for one of the trading magazines, which was published way back in 2003.

I called it the “do or die” trade, and simply put; it is an exercise where you do the following...

Go back over your last 50 live trades and calculate how much MORE MONEY you would have made if you had simply set your stops, then your take profit orders... AND THEN WALKED AWAY!

Most of the time, by simply taking your mind out of the equation once the trade is entered, you will radically increase your captured profits.

A lot of trader’s forecasts are decent, and then they just cut themselves off at the knees by second-guessing and exiting early, trailing stops too tight, etc...

So take some time to look back at your recent trades and find those where you exited early, and sure enough... the damn thing went to your profit target WITHOUT YOU!

If you had stuck to your plan... how much more money would you have in your account right now?

To Learn How To Accurately and Consistently Forecast Market Prices Just Like Me, Using Market Vulnerability Analysis™, visit Market Forecasting Academy for the Free 5 Day Market Forecasting Primer.

Check back to see my next post!

Bo Yoder

Market Forecasting Academy

About Bo Yoder:

Beginning his full-time trading career in 1997, Bo is a professional trader, partner at Market Forecasting Academy, developer of The Myalolipsis Technique, two-time author, and consultant to the financial industry on matters of market analysis and edge optimization.

Bo has been a featured speaker internationally for decades and has developed a reputation for trading live in front of an audience as a real-time example of what it is like to trade for a living.

In addition to his two books for McGraw-Hill, Mastering Futures Trading and Optimize Your Trading Edge (translated into German and Japanese), Bo has written articles published in top publications such as TheStreet.com, Technical Analysis of Stocks & Commodities, Trader’s, Active Trader Magazine and Forbes to name a few.

Bo currently spends his time with his wife and son in the great state of Maine, where he trades, researches behavioral economics & neuropsychology, and is an enthusiastic sailboat racer.

He has an MBA from The Boston University School of Management.

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation for their opinion.