In part one of this article, we discussed how the recent decline in Zillow, Redfin, and Opendoor share prices could reflect a concern that the risks involved in holding large home inventories while attempting to "flip houses" could present for these Real Estate firms. The recent 50% price drop in the share price levels should send a fairly strong warning to investors that these "flipping" processes contain a moderate degree of underlying risk and extended costs in a super-heated and potentially peaking Real Estate trend.

It has been reported that Zillow increased the purchase of homes for their Ibuyer program, from 86 homes in Q2:2020 to 808 homes in Q3:2020, to 3805 homes in Q2:2021. We’ll learn more about their Q3:2021 home buying efforts when Zillow announced earnings.

It has also been reported that Zillow sold more than $1 billion in bonds to investors to fund this operation that includes using their Zestimate algorithm to buy homes quickly, renovate/flip them, and put them back on the market. The super-heated Real Estate market has driven these firms into speculative trading of houses in an open and often hostile market environment. Taking a bigger leap is Opendoor, which purchased 8,494 homes in Q2:2021. This is a massive inventory of homes that may require many months or years to renovate/sell.

Is this trend a buying opportunity for Zillow, Redfin, and Opendoor – or a warning?

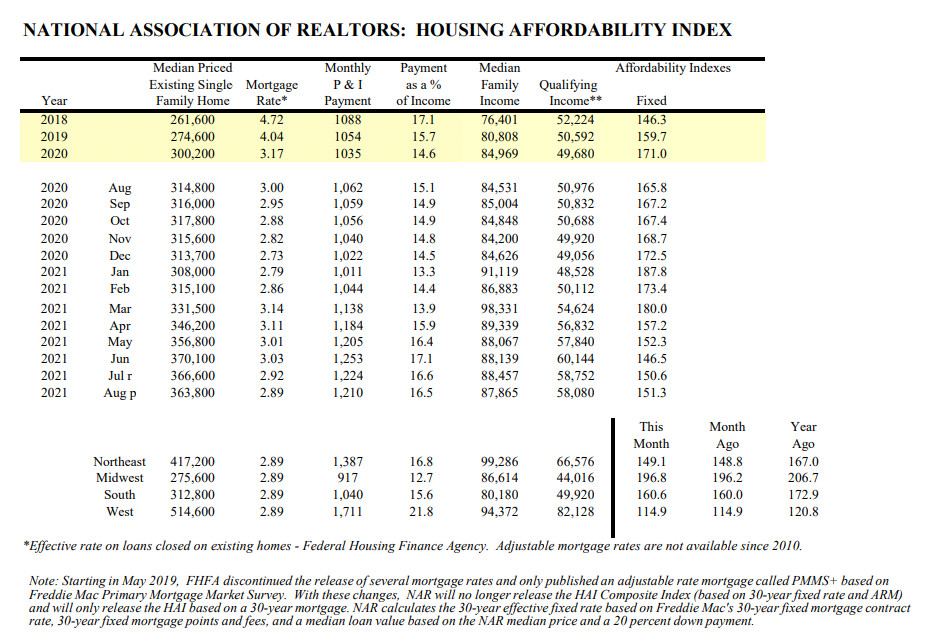

Recent data from the National Association of Realtors shows the median single-family home price in the US rose nearly 40% from the average 2018 price level. That means we've seen home prices skyrocket nearly 40% higher in less than three years. The Affordability Index for homes has fallen -19.43% – reaching near to the lowest level since 2018.

Interest rates rising as inflation trends continue to push the US Fed into action, the Affordability Index is almost certain to continue to fall as "flippers" are continually attempting to push home prices higher and higher. The mechanics of this process, buying and flipping, requires a strong demand for housing while price levels continue to allow for support increases. Once that dynamic breaks down, the risk of owning/flipping homes in an unfavorable market environment increases dramatically.

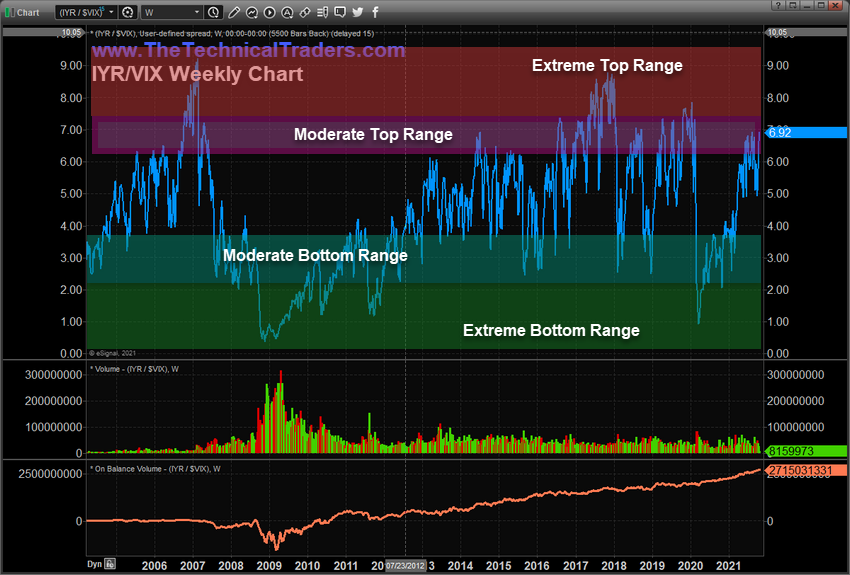

My research suggests the current price levels reflected in IYR, the Real Estate ETF, are already pushing into the Moderate/Extreme Topping range. This suggests that historical price relationships related to continued price advances in the Real Estate sector may be nearing a peak.

Considering the recent rise in Interest Rates as well as the incredible rise in median home prices over the past 3+ years, should the US Fed take any action to raise interest rates by even a small amount, 0.25% to 0.50%, the Housing Affordability Index could collapse to levels below 125 fairly quickly – pushing prices down as the cost of borrowing increases.

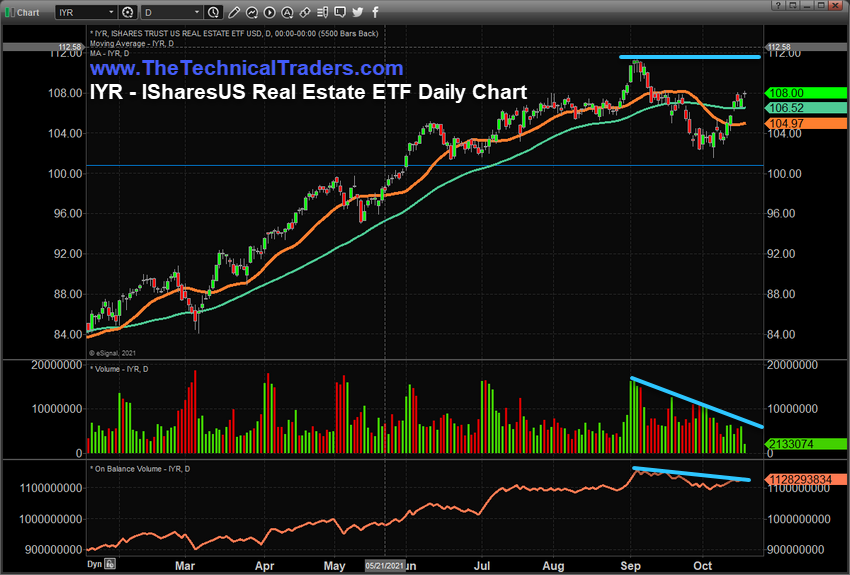

IYR peaks near $112 – will real estate attempt another move higher?

This Daily IYR chart highlights the recent peak near $112, which was set up in early September 2021. Given the downward rotation in Zillow, Redfin, and Opendoor, I suspect this peak in IYR may be a very clear exhaustion peak in price after an incredible run for US Real Estate and the Real Estate Sector.

The current data is showing weaker affordability levels while prices have risen nearly 30% over the past three years. In my opinion, any increase in interest rates by the US Fed may push the delicate housing market over the edge. The US Federal Reserve wants to keep the US markets rallying like this as long as possible, but the eventual contraction phase in the markets is likely going to start when the US Federal Reserve starts raising interest rates to help fight inflation.

The data I have presented in this article suggests companies like Zillow, Redfin, Opendoor, and other's that are "flipping" real estate right now are engaged in very risky behavior as affordability levels have reached multi-year lows (indicating very poor affordability levels) and as the US Fed is actively discussing raising interest rates soon. The idea of holding high-priced home inventory while attempting to renovate and flip these assets for higher sales prices over the next 6 to 12+ months seems fraught with risks.

In my opinion, the only thing that could change the dynamics of this fragile market environment is if interest rates decreased to support more affordability or if home prices drop by more than 15% to support greater affordability.

There is a shift taking place in the Real Estate market. The declining price levels in Zillow, Redfin, Opendoor, and IYR are suggesting that traders perceive greater risks associated with future profits/earnings related to the economic dynamics at play. Affordability, price levels, the US Federal Reserve, and consumer sentiment are all at play right now as we head into Christmas 2021.

The March 2020 COVID event created a boost in affordability as interest rates fell from over 4% to levels near 2.75%. This pushed home price affordability up to 187.8 (very affordable). Currently, that dynamic has ended, and rising interest rates after a nearly 30% increase in home price levels make for a very fragile real estate market environment. We need to see how the US Fed reacts over the next few months and how consumers react to market dynamics throughout this Christmas season.

The warning signs are there if you look hard enough. But the US Federal Reserve wants this party to continue for as long as possible. I don't see interest rates falling much further below 2.75%, and the only answer then becomes a decrease in-home price levels. It will be interesting to see how this plays out.

You don't have to be smart to make money in the stock market; you just need to think differently. That means: we do not equate an "up" market with a "good" market and vi versa – all markets present opportunities to make money!

We believe you can always take what the market gives you and make CONSISTENT money.

Learn more by visiting The Technical Traders!

Chris Vermeulen

Technical Traders Ltd.

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation for their opinion.

They aren't really "homes" of course. They are houses. "It isn't a home until you move in and make it one".