Traders expect the U.S. Fed to soften as Chairman Powell suggested they have reached a neutral rate with the last rate increase. The US stock markets started an upward trend after the last 75bp rate increase – expecting the U.S. Fed to move toward a more data-driven rate adjustment.

My research suggests the U.S. Federal Reserve has a much more difficult battle ahead related to inflation, global market concerns, and underlying global monetary function.

Simply put, global central banks have printed too much money over the past 7+ years, and the eventual unwinding of this excess capital may take aggressive controls to tame.

Real Estate Data Shows A Sudden Shift In Forward Expectations

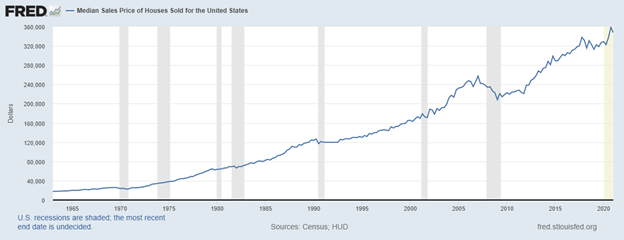

The US housing market is one of the first things I look at in terms of consumer demand, home-building expectations, and overall confidence for consumers to engage in Big Ticket spending. Look at how the US Real Estate sector has changed over the past five years.

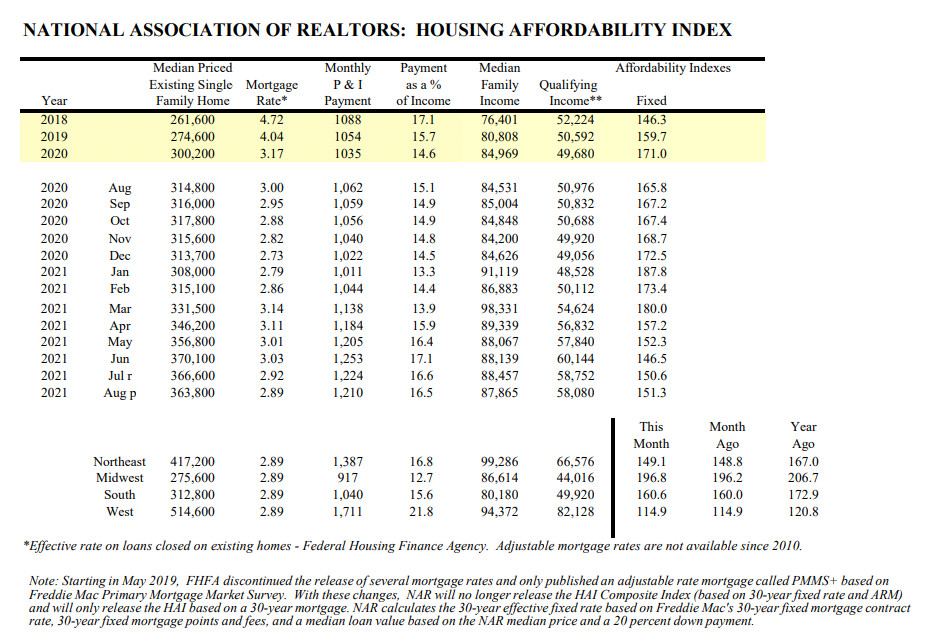

The data comparison chart below, originating from September 2017, shows how the US Real Estate sector went from moderately hot in late 2017 to early 2018; stalled from July 2018 to May 2019; then got super-heated in late 2019 as extremely low-interest rates drove buyers into a feeding frenzy.

As the COVID-19 virus initiated the US lockdowns in March/April 2020, you can see the buying frenzy ground to a halt. Between March 2020 and July 2020, Average Days On Market shot up from -8 to +17 (YoY) – showing people stopped buying homes. At this same time, home prices continued to rise, moving from +3.3% to +14% (YoY) by the end of 2020. Continue reading "Should We Prepare For An Aggressive U.S. Fed?"