This week we have a stock market forecast for the week of 2/13/2022 from our friend Bo Yoder of the Market Forecasting Academy. Be sure to leave a comment and let us know what you think!

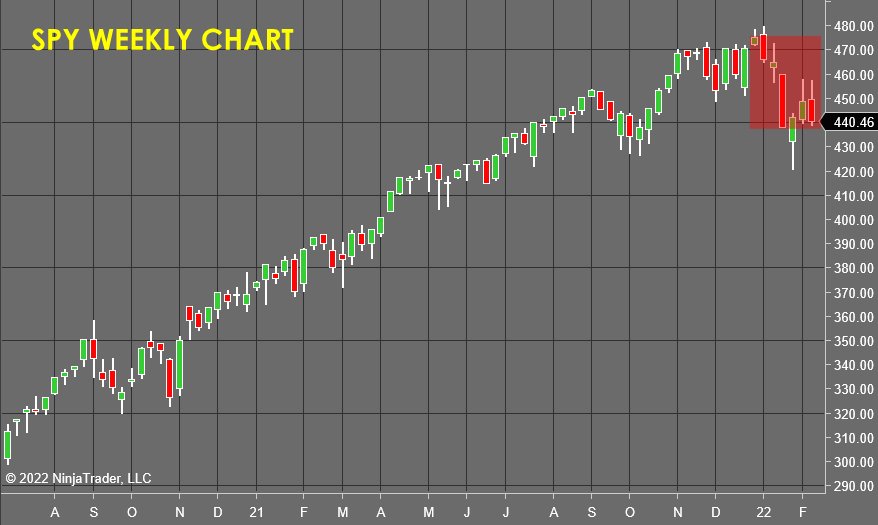

The S&P 500 (SPY)

After literally years of watching the S&P 500 top out, correct about 10%, then running in a straight line back to highs due to the Fed printing money. I think this is the lower high that I have been waiting for. As I have stated before, the Fed is losing control of the economy, and if this is true, then this is the best short entry available.

This short trade will live or die based on the action of the Fed, but if I'm right and this is the moment in history where the "pump" fails, the downside potential will be VERY rich.

It's time... now, let's see how wacky things get over the next couple of weeks. As the old Chinese saying goes, "may you live in interesting times"!

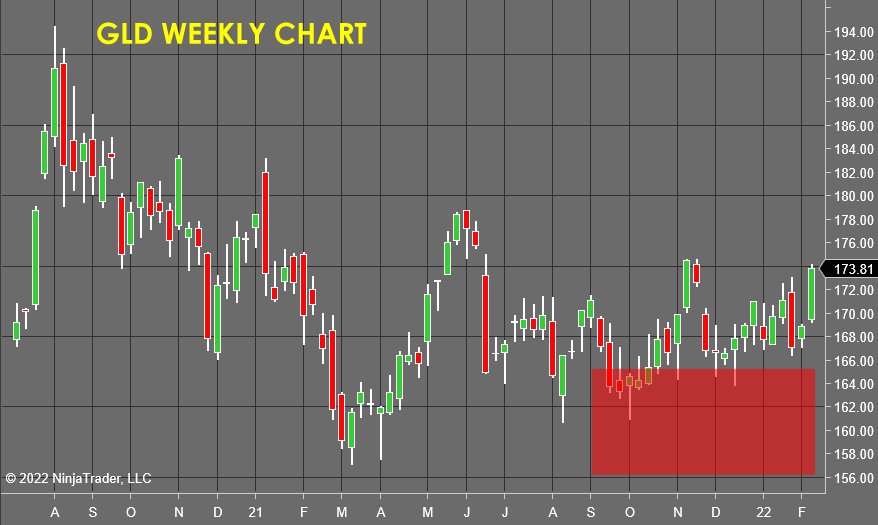

SPDR Gold Shares (GLD)

Gold "woke up" in a big way this week, and the power we see on the bullish side in this market gives me confidence that we are at a major turning point for the markets.

There is a major line in the sand at $180 per share in this market. If that breaks, we should see a big surge in bullish interest in this precious metals market.

I've been "sitting tight" for a while in this position; now it's time to see if that investment is going to pay off the way that I have forecast it will!

iShares Silver Trust (SLV)

Silver survived its bearish surge nicely, and the selling pressure was rejected to form a higher low on the weekly chart.

This is a "catalyst" move, and I would expect to see the resistance around $23 per share break in the next week or two. When this occurs, there will be a big acceleration in buying pressure, and this market should begin to trend in earnest.

LKQ Corporation (LKQ)

LKQ Corporation distributes replacement parts, components, and systems used in the repair and maintenance of vehicles.

With the shift in manufacturing policy in China away from serving global clients to a new focus on internal markets, the supply chain that LKQ relies on is no longer active. This should produce some serious challenges for this company, and the stock is likely to react badly to this new reality.

My forecast is for an acceleration to the downside, and any prices within the red zone would be an attractive short opportunity with protective stop-loss orders set above the red zones highs at $59 per share.

To Learn How To Accurately and Consistently Forecast Market Prices Just Like Me, Using Market Vulnerability Analysis™, visit Market Forecasting Academy for the Free 5 Day Market Forecasting Primer.

Check back to see my next post!

Bo Yoder

Market Forecasting Academy

About Bo Yoder:

Beginning his full-time trading career in 1997, Bo is a professional trader, partner at Market Forecasting Academy, developer of The Myalolipsis Technique, two-time author, and consultant to the financial industry on matters of market analysis and edge optimization.

Bo has been a featured speaker internationally for decades and has developed a reputation for trading live in front of an audience as a real-time example of what it is like to trade for a living.

In addition to his two books for McGraw-Hill, Mastering Futures Trading and Optimize Your Trading Edge (translated into German and Japanese), Bo has written articles published in top publications such as TheStreet.com, Technical Analysis of Stocks & Commodities, Trader's, Active Trader Magazine and Forbes to name a few.

Bo currently spends his time with his wife and son in the great state of Maine, where he trades, researches behavioral economics & neuropsychology, and is an enthusiastic sailboat racer.

He has an MBA from The Boston University School of Management.

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation for their opinion.