Hello traders everywhere. The Wall Street Journal reported that the Federal Reserve is closer than expected to ending its balance sheet unwind. The Fed's decision is a key consideration for investors as they gauge the extent to which the central bank will tighten its monetary policy moving forward.

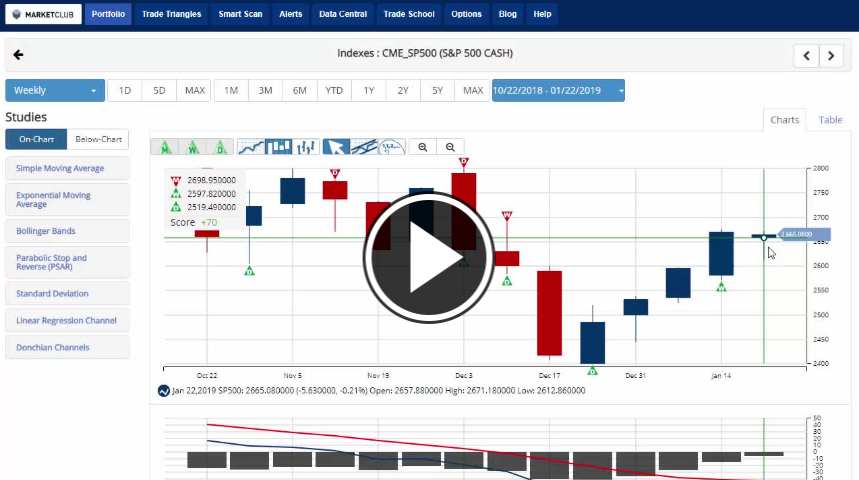

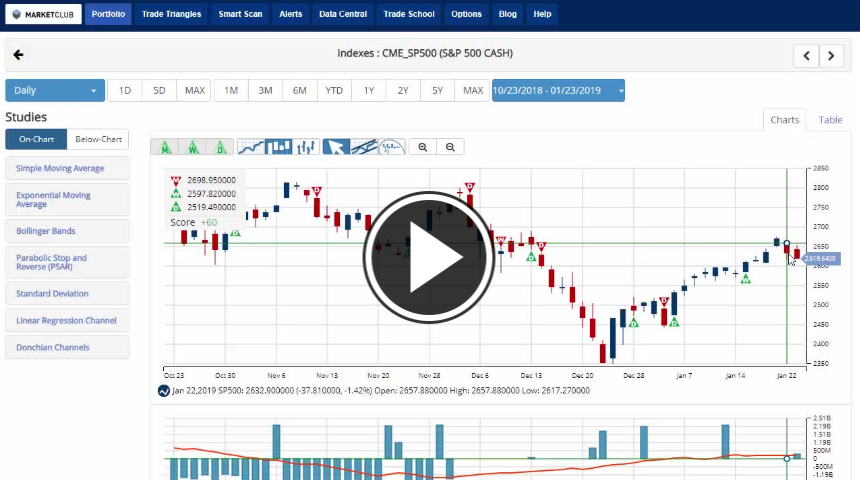

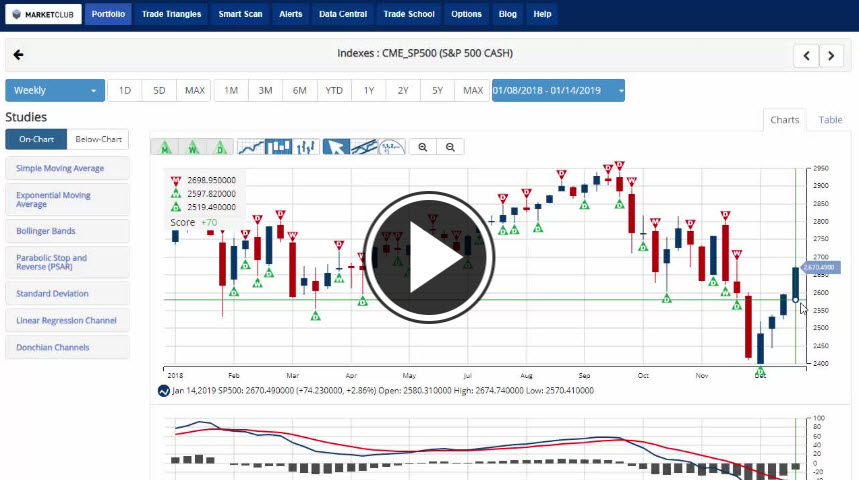

That news has spurred the stock market higher with all three major indexes up over one percent on the day. This week ending push higher could help all three indexes finish with weekly gains. As it stands right now the DOW is in positive territory with a weekly gain of +.50% marking it's fifth straight weeks of gains, but the S&P 500 and NASDAQ are just barely sitting in negative territory.

Key Levels To Watch Next Week:

- S&P 500 (CME:SP500): 2,524.56

- Dow (INDEX:DJI): 23,304.59

- NASDAQ (NASDAQ:COMP): 6,741.40

- U.S. Dollar (ICE:DX): 96.52

- Gold (NYMEX:GC.G19): 1,278.90

- Crude Oil (NYMEX:CL.H19): 53.94

- Bitcoin (BITCOIN:BITSTAMPUSD): 4,112.00

Every Success,

Jeremy Lutz

INO.com and MarketClub.com