Hello traders and MarketClub members everywhere! Here we are, starting a shortened trading week before the big Thanksgiving holiday here in the US.

For most of us, Thanksgiving conjures up pictures of family and lots of food, sitting around a table sharing good times. And yes, perhaps eating too much at times. With that thought in mind, I decided to search for three healthy food stocks that would not add inches to your waistline or overpower you with processed food.

In the last several years, there has been a big movement into eating fresh and healthier food and knowing where the food is coming from. No where is this more prevalent than with the millennials and the aging baby boomer population here in the US.

It's hard to go into a supermarket or food store now and not see people actually reading the labels for perhaps the first time and not buying into the advertising myth for that particular product. I view this as a very positive sign, particularly for retailers who get that the consumer wants a better and healthier alternative to all the processed food that's out there.

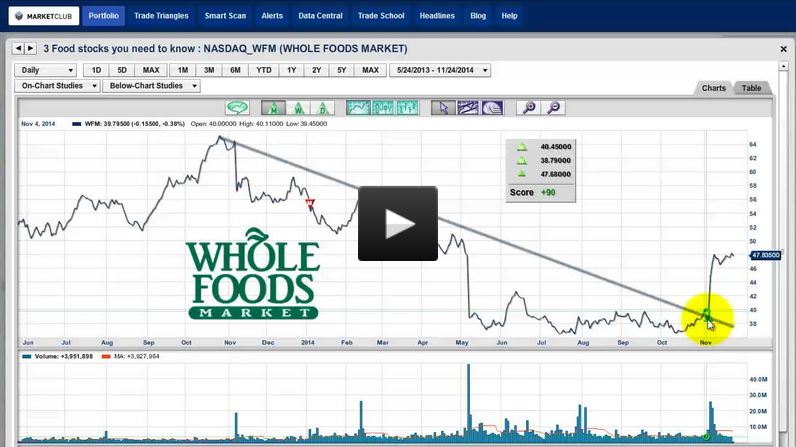

So let's get started and look at the three stocks I'm going to be examining in today's video. The first stock I will be looking at is Whole Foods Market Inc. (NASDAQ:WFM), which is currently trading around $48 a share. The next stock is The Fresh Market Inc. (NASDAQ:TFM), which is trading around the $39 level. The last stock on my shopping list is Sprouts Farmers Market Inc. (NASDAQ:SFM), which closed last Friday around $32.

In today's short video, I'll be examining all three companies and showing you my projections for each of these three stocks. I will also be pinpointing a level that could make one of these stocks skyrocket.

As always, I welcome your comments and feedback below this post, so please feel free to share with me what you think of these three stocks or the market in general.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub