On 6th of April, the U.S. Department of the Treasury published the 2023 DeFi Illicit Finance Risk Assessment, the first illicit finance risk assessment conducted on decentralized finance (DeFi) in the world. The assessment considers risks associated with what are commonly called DeFi services.

The document is 42 pages long. This report looks at how criminals are using DeFi services to move and hide money illegally. DeFi services use technology called blockchain and smart contracts to allow people to make transactions without banks or other financial institutions.

However, many DeFi services are not following the rules meant to stop money laundering and financing terrorism. Some DeFi services are trying to avoid these rules by claiming to be fully decentralized, but this doesn't excuse them from following the rules.

The report recommends improving the rules and regulations for DeFi services to make sure they follow the laws and don't help criminals.

The cryptocurrency market may face regulatory scrutiny as authorities look to increase oversight on digital assets, so be informed and prepared for real bombshells in the not so distant future.

I would love to see your comments on this news.

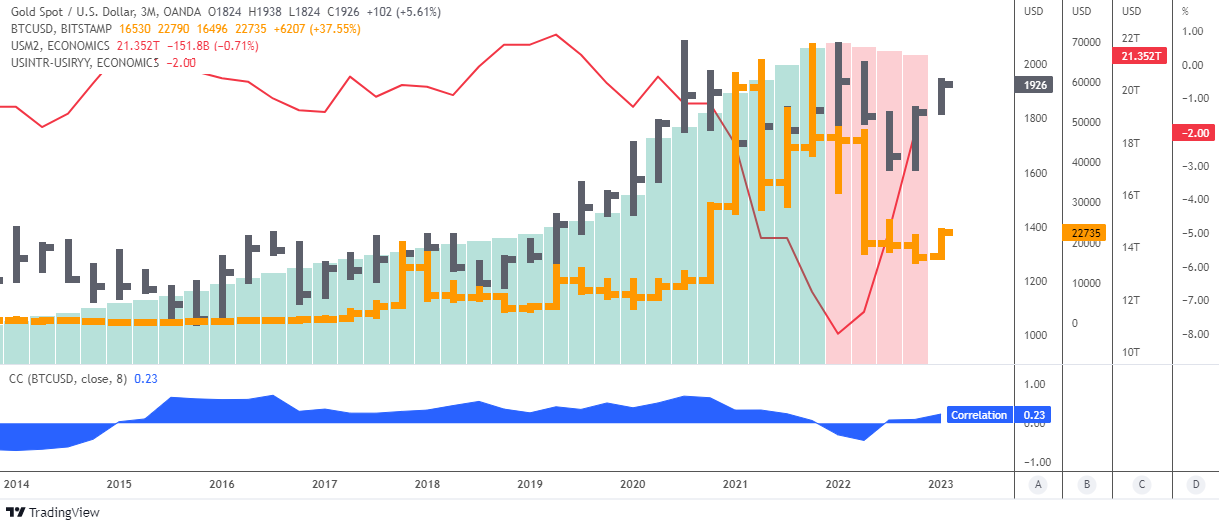

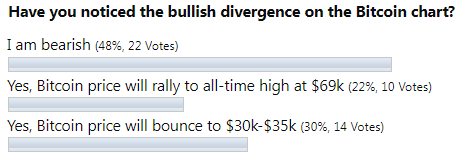

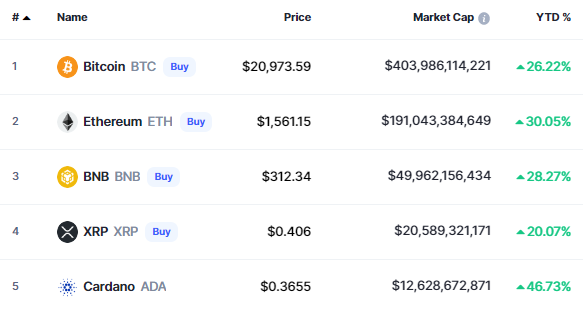

Let me update some crypto charts to snapshot what’s going there. The comparison chart of major cryptos vs. the market follows below. Continue reading "US Treasury Touches "Crypto-waters""