Hello MarketClub members everywhere. This morning crude oil moved over $51 a barrel, its best level in nine months. In the last couple of years, there has been a strong correlation between the stock market and the price of crude oil. But, is that correlation about to decouple?

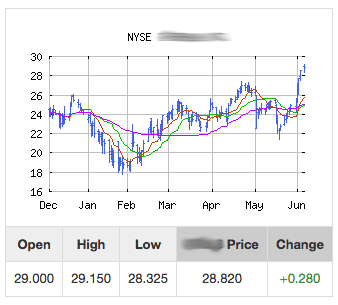

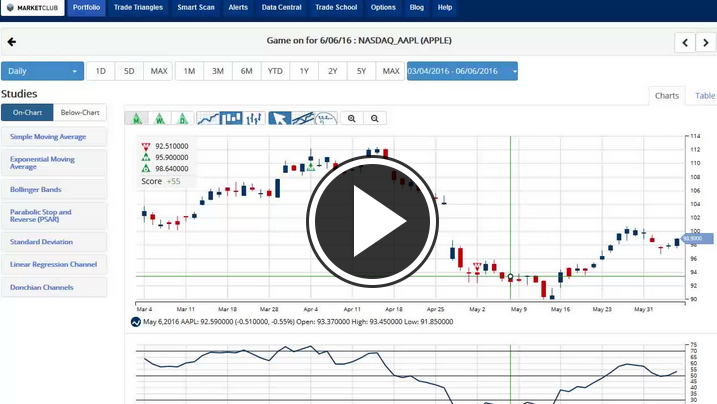

In today's video, I will be analyzing crude oil (NYMEX:CL.N16.E) and providing you with potential profit targets. Now that the $50 level has been breached, you can look at $50 as perhaps the new floor for crude oil. Since the beginning of the year, I have seen a fairly consistent move to the upside that many economists missed, yet the Trade Triangles have flourished with their non-opinionated approach to the market. Continue reading "Is The Stock Market Decoupling From Crude Oil?"