Apple Inc. (NASDAQ:AAPL)

Yesterday, the 900-pound gorilla, Apple Inc. (NASDAQ:AAPL) reported earnings and by all accounts they were outstanding, far outpacing all of the pre-earnings estimates. But the reality is, the stock price barely moved and is up just 1.5% in today's early trading. I still believe that Apple is not out of the woods yet and it is yet to have any new blockbuster products or innovations.

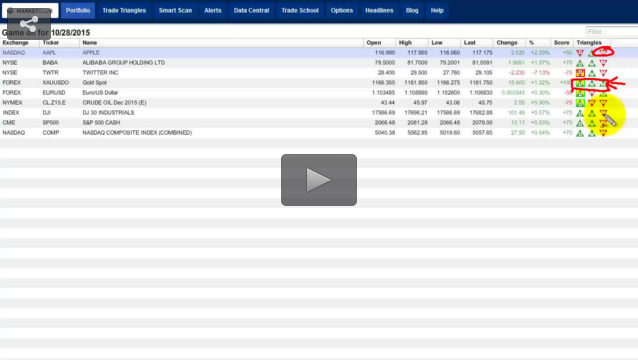

The weekly and monthly Trade Triangles are indicating that Apple is in a trading range. The longer-term monthly Trade Triangle is red indicating the major trend remains negative. A tipping point for Apple on the downside would be a move below $109.50, that would turn all Trade Triangles red indicating a downward move. On the upside, Apple needs to move over $122.60 to reignite the bull trend. Continue reading "Trends And Tipping Points For Apple, Alibaba And Twitter"

On Sunday, October 11th, INO.com employees broke out their spandex and jumped on their bikes to participate in the

On Sunday, October 11th, INO.com employees broke out their spandex and jumped on their bikes to participate in the