Introduction

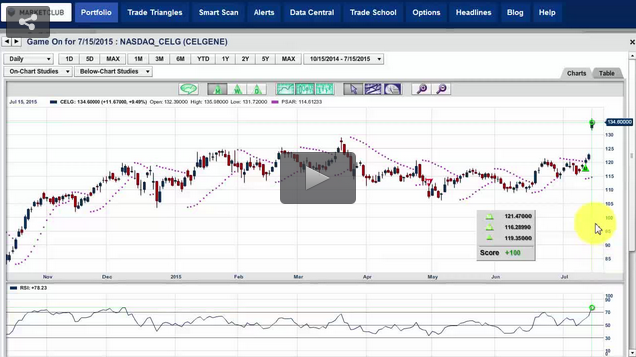

The biotechnology cohort has transformed into a secular growth sector witnessed by spectacular performance in the face of bull and bear markets as well as economic troubles domestically and abroad. The biotechnology sector has been on an unprecedented performance streak in both annual and cumulative performance over the past 10 years and accentuated during the latest 5-year timeframe. The biotechnology sector can be highly volatile, however I posit that this cohort has established itself as a secular growth sector and thus doesn't fit the mantra of high-risk high-reward based on annual and cumulative performance throughout any market condition. I content that long-term data support this secular viewpoint without the perceived inherent high-risk. Short sellers contend that the sector is overvalued and frothy while its multi-year run has resulted in a bubble imminent of bursting. Some commentators have recommended shorting the sector or relinquishing portfolio positions with exposure to the biotechnology sector altogether. In brief, I'll be using The iShares Nasdaq Biotechnology (IBB) as a proxy to substantiate this thesis. In brief, IBB holds 150 biotechnology firms listed on the Nasdaq with a minimum market capitalization of $200 million thus spanning small, mid and large-cap companies. Greater than ~30% of assets are devoted to small and mid-cap growth names while ~65% is devoted to large-cap growth names. These companies are involved in early clinical development at the forefront of innovation and research to drive the development and potential commercialization of drugs targeting a variety of diseases and unmet medical needs domestically and abroad.

High-Level Overview

• The Biotechnology cohort has solidified itself as a secular growth sector over the past decade while defying market downtrends in the face of economic woes domestically and abroad

• Using IBB as a proxy for the Biotechnology cohort, this sector doesn't fit the mantra of high-risk high-reward based on annual performance throughout bull and bear markets

• Long-term data on this cohort supports very high returns without the perceived high risk

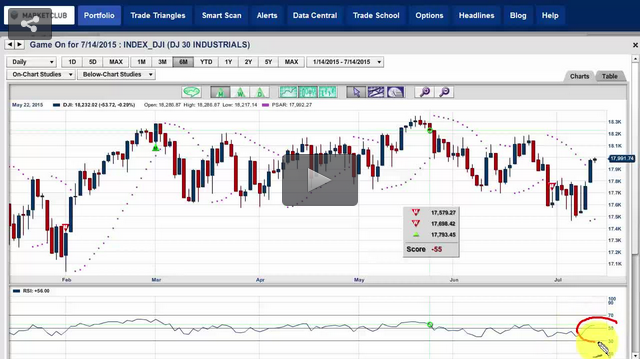

• During the market crash of 2008, IBB outperformed the S&P 500, Nasdaq and Dow Jones by 24.8%, 27.8% and 19.7%, respectively

• Over the past 5 years through 2015 thus far, IBB has posted an average annual return of 33%

• Over the past 10 years IBB has cumulative returns of over 425%, unparalleled by an any major index

The biotech secular growth

The returns for IBB have been very impressive to say the least in both annual and cumulative performance, unparalleled by any major index. Over the past 10 and 5 year timeframes, IBB has posted cumulative returns of over 425% and 390%, respectively. Continue reading "The Biotechnology Sector Continues To Defy Markets With Secular Growth"

Rachel has been riding horses for over 25 years. She first fell in love with horses after her mother gave her a My Little Pony set when she was 5 years old. Throughout her life, she has trained horses, taught lessons, managed an equestrian retail shop and cared for her own horses. She has also volunteered with numerous organizations who help rescue horses as well as provide therapeutic resources for those in need through equestrian programs.

Rachel has been riding horses for over 25 years. She first fell in love with horses after her mother gave her a My Little Pony set when she was 5 years old. Throughout her life, she has trained horses, taught lessons, managed an equestrian retail shop and cared for her own horses. She has also volunteered with numerous organizations who help rescue horses as well as provide therapeutic resources for those in need through equestrian programs.