At the beginning of the week, I stated that this week would be a game changing week. It's beginning to play out that way with tomorrow being the key day.

Yesterday, the Trade Triangles issued a major buy signal in gold (FOREX:XAUUSDO). Could this possibly be indicating that inflation is on its way? I have said all along that the only way the United States can get out of its multi-trillion dollar deficit hole is to inflate asset prices.

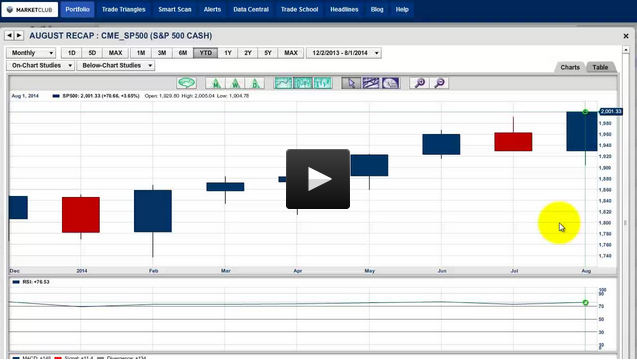

Today, the Trade Triangles issued a buy signal on the Dow (INDEX:DJI). Can the NASDAQ and S&P 500 follow behind?

In today's video, I will be looking at gold and where I think it's headed to the upside and the implications it could have on equity prices. Continue reading "Did You Miss These Two Signals?"