The FOMC meeting ended yesterday as many had expected. Besides some marginal tweaks in the language, the message remained the same; data will determine our rate policy. Now, hours after the latest US GDP figures hit the newswires, it seems that Dollar Bulls are gearing up towards a September rate hike. Part of their rationale is because the data is good enough to sustain a rate hike. And that’s essentially true. With wages growing annually at 2%, Core Inflation at 1.7%, unemployment at 1.8% and now GDP bouncing back, indeed, a rate hike is warranted. At the same time, there are essentially no signs that the US economy is overheating. Rather, we’re seeing notable signs of stabilization. This, then, begs the question: How many rate hikes can the US handle in the upcoming year?

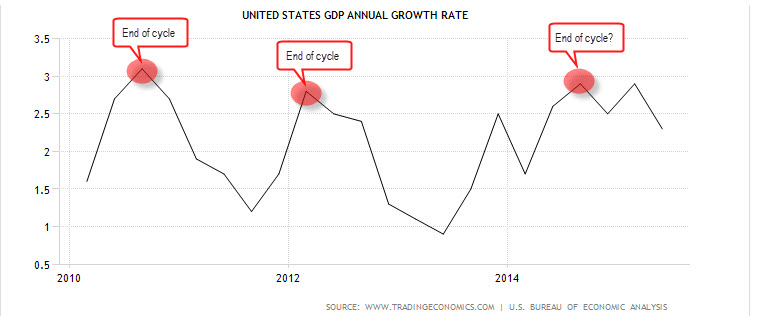

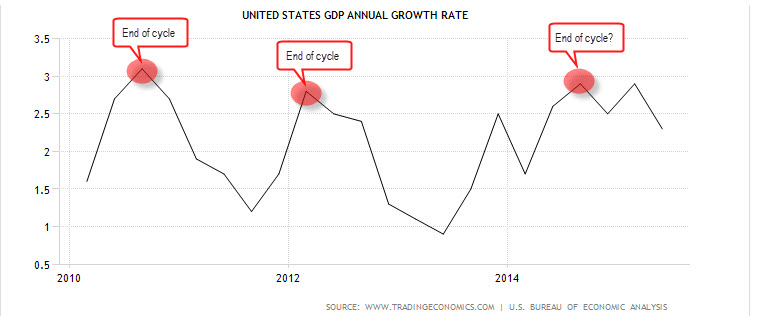

No Escape Velocity in GDP

When we examine the dynamics of GDP growth, it’s evident that the US GDP growth rate is not breaking the range. Instead, it has the same cycles that tend to end around the 3% growth rate. After that, the US economy tends to decelerate, only to regain momentum later. But this range of growth has not been broken. This means that there’s no evidence that US GDP is at escape velocity, a pace which would require several rate hikes a year.

Chart courtesy of Tradingeconomics.com

No Escape Velocity in Inflation

When we examine US Core Inflation, a similar picture emerges. US inflation is within the Fed’s 2% range and is showing no signs of overheating, i.e. escaping the Fed’s target. Rather, every time it reaches the 2% range, it tends to cool and then slide slightly lower. Continue reading "How Many Rate Hikes Can The U.S. Handle?" →

If you haven’t heard by now, the Fed is back at it! Bud Conrad of Casey Research has written a great article on how it is affecting current markets and what to expect in the near future. Be sure to take a look and comment below with your own thoughts. For more from Bud and Casey Research

If you haven’t heard by now, the Fed is back at it! Bud Conrad of Casey Research has written a great article on how it is affecting current markets and what to expect in the near future. Be sure to take a look and comment below with your own thoughts. For more from Bud and Casey Research