Today I would like to share with you some observations I have made in the Gold (FOREX:XAUUSDO) market. This market is looking more and more interesting right now. In this short 4 minute video, I point out some key technical characteristics that I believe will be driving gold in the future. I also give you a very important level in gold that, in my opinion, will skyrocket gold to new highs.

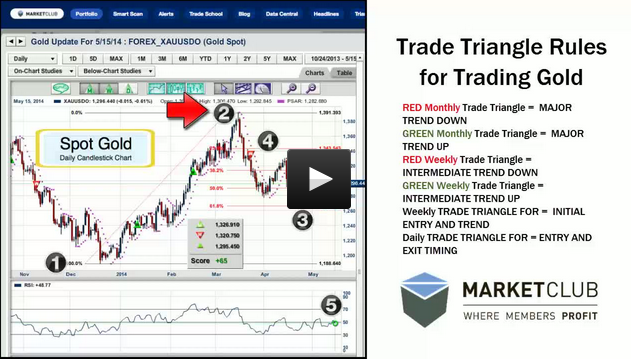

If you have a few minutes, you may enjoy learning how you can trade gold using MarketClub's Trade Triangles. In the past, the success rate of the Trade Triangles in the second quarter of the year was about 80%. With that in mind, I am watching Gold (FOREX:XAUUSDO) very closely.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub