Throughout my trading career, two things of have stuck in my mind that I learned a long time ago on the floors of the Chicago Mercantile Exchange. I was trading for my own account and a select few customers in a space that was both hostile and friendly at the same time.

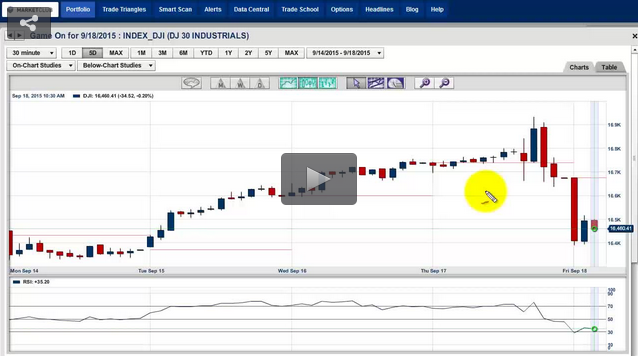

The first was, "the trend is your friend." Trends tend to persist longer than most people expect. Just look at the recent bullish trend in the equity markets that has been going on now for six years. By any mark in history this is an old and tired bull market. Only one time in history did a bull market trend ever extend to seven years. As they say when you climb Mount Everest, we are now in thin air.

"The trend is your friend" is an amazing thing to remember when you are trading because that is where the big money is made.

The next saying I learned as a young trader in the pits of Chicago was, Continue reading "Repeat, The Trend Is Your Friend"