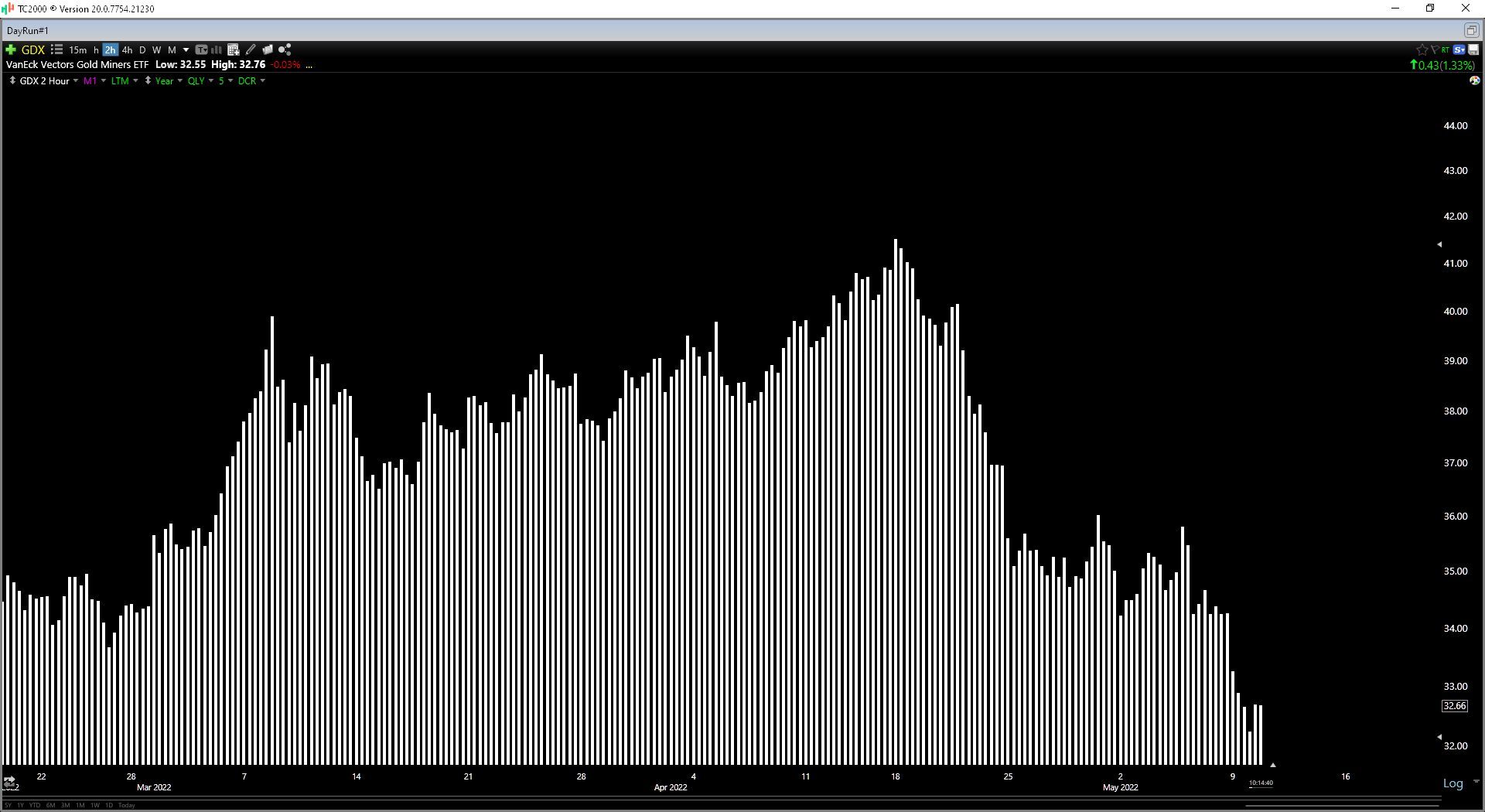

It’s been a rollercoaster ride of a year for the Gold Miners Index (GDX), with the ETF starting the year up more than 15% and massively outperforming the major market averages, only to suffer a 48% decline over the next five months.

Since then, the GDX has returned to outperforming, and some of the best names, like i-80 Gold (IAUX), are now up more than 50% from their lows.

This extreme volatility is why it can be difficult to trade the Gold Miners Index successfully. The reason is that one must be ultra-patient when establishing new positions to avoid large drawdowns during the down cycle, but being too complacent at the lows can be costly as the index can turn on a dime when it does bottom.

Fortunately, while several of the best names are already off to the races and out of low-risk buy zones, a couple of stocks are still in the proverbial stable and trading at attractive valuations. In this update, we’ll look at two names that offer large safety margins.

Sandstorm Gold (SAND)

Sandstorm Gold (SAND) is a $ 1.6 billion precious metals royalty/streaming company.

It finances developers and producers in the gold and silver space, giving them capital upfront to build or expand their assets. In exchange, Sandstorm receives either a royalty on the asset over its mine life or a stream on the asset, meaning that Sandstorm has a right to buy a percentage of metal produced at a fixed cost well below the current spot price of gold/silver.

Since royalty/streaming companies typically have royalties/streams on over 20 assets, they are much more diversified than producers with 5-10 mines.

They also have much higher margins, given that they do not have to pay for labor, chemicals, fuel, explosives, and transportation but simply sit back and collect their metal deliveries from these assets.

Finally, the major benefit to owning royalty/streaming companies is that they are not required to spend annually on sustaining capital to maintain an operation, including mine development, drilling, and tailings expansions. In fact, any added resources are very beneficial, given that the royalty/stream is bought and paid for already. Hence, this is a proverbial cherry on top.

Unfortunately, while Sandstorm benefits from this superior model that carries very low risk, the company has had a tough year in 2022. This is because it went out and completed two major acquisitions ($1.1BB value), a smart move, and these deals transformed its portfolio from an average royalty/streamer to one with a phenomenal portfolio. Continue reading "2 Gold Miners With Large Safety Margins"