Introduction

The culmination of extraneous events such as sustained lower oil prices, an ostensibly imminent rate hike and weakness in China have indiscriminately plummeted the biotech sector as of late. Now a second and more specific wave of sector related stories such as price gouging by Turing Pharmaceuticals and the subsequent comments by Hillary Clinton have exacerbated this sector decline. These former events are seemingly unrelated to the biotechnology sector, yet this group has been taken along for the downhill ride with the broader indices in lock-step. The latter events have been detrimental to all biotechnology stocks as this is a direct threat to pricing power and our capitalism based structure.

The unprecedented secular growth streak in biotech has been more than tested as of late with biotechnology officially in bear territory. These latest events, some unrelated and others directly related to the biotech sector, may provide a unique opportunity to add to a current position or initiate a position over time as this correction continues to unfold. Based on annual and cumulative performance throughout both bear and bull markets, The iShares Nasdaq Biotechnology (ticker symbol: IBB) may provide the opportunity investors have been waiting for in the face of our current market conditions. IBB is down 25% from its 52-week high, shares have plunged from $400 to $295 per share during the recent market weakness, presenting a potential buying opportunity.

Price gouging and Hilary Clinton

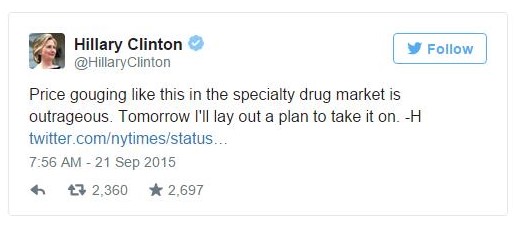

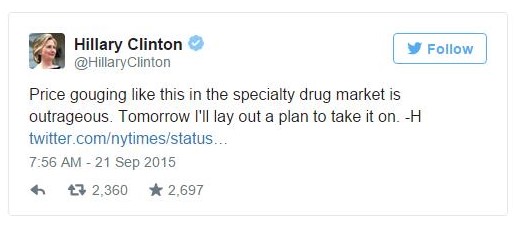

Recently, Turing Pharmaceuticals and its CEO Martin Shkreli garnered criticism after the company boosted the price of Daraprim from $13.50 to $750 per pill, resulting in a greater than 5,400% increase after acquiring the drug in August. This price gouging of a decades’ old drug drew fire from the general public on social media and, in particular, the presidential candidate and Democratic front-runner Hillary Clinton (Figure 1).

Figure 1 – Tweet by presidential candidate and Democratic front-runner, Hillary Clinton, referring to the drug price gouging

This price gouging incident has elicited widespread backlash, and in my opinion rightfully so, however this criticism has been unfairly painted across the entire sector. It’s noteworthy to point out that Democratic lawmakers have requested pricing policies and further information on pricing of drugs by Canadian drug maker Valeant Pharmaceuticals. Despite the public backlash and public statements by lawmakers, I believe this is a temporary headwind rooted in the public relations arena. Continue reading "The Bruised And Battered Biotech Sector - Buying Opportunity Arises" →