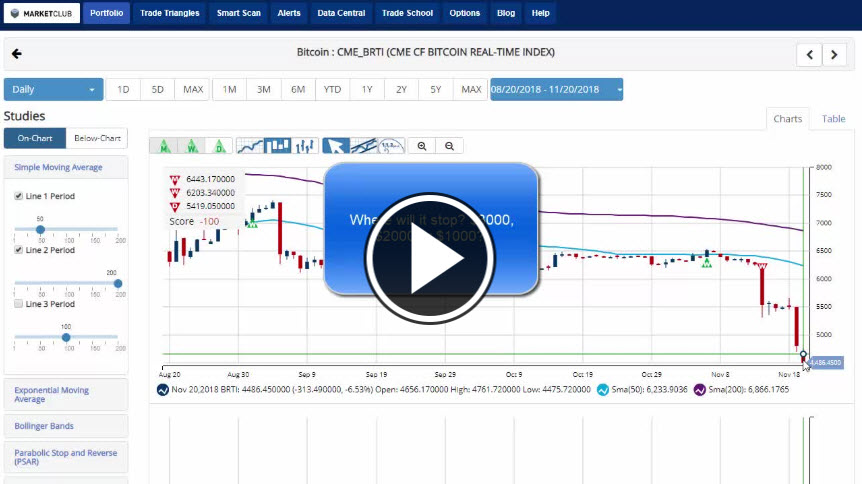

In 2017 Bitcoin became a household name as the price went from below $1,000 per coin at the start of the year to well over $19,000 as the year came to an end. In 2018, the price of the most well-known cryptocurrency fell from its lofty heights to close the year below $4,000 per coin.

As we roll into 2019, some cryptocurrency experts are predicting Bitcoin to break the 2017 record high and fulfill its destiny of going as high as $1,000,000 per coin by 2020. Other more modest expectations have Bitcoin at around the $50,000 range by year end 2019. But the mass consensus of Bitcoin experts has the crypto ending the year in that $20,000 range.

I personally still believe that is way, way, way too high, and I’ll go even as far as saying Bitcoin will end 2019 lower than where it starts the year.

There are two reasons I believe Bitcoin will not perform well in the coming year. Continue reading "Will 2019 Be A Better Year For Bitcoin?"