Last November I shared a promising trading opportunity to play on the Modern “Gold Rush” For Cryptocoins. Like the Great Gold Rush, I thought that those who sell equipment could benefit from new a “tulip mania” as this crypto buzz was called in the media.

I selected three chip makers, which were well known for the broad use of their products in the “mining” of cryptocoins. These companies are NVIDIA Corporation (NVDA), Advanced Micro Devices, Inc (AMD) and Taiwan Semiconductor Manufacturing Company, Limited (TSM). Firstly, I made the same comparative chart analysis of their stocks as I usually do for the classic mining stocks; it is funny that the word “mining” I used here has a totally different meaning.

We were on the right path as despite the market euphoria there was one stock, which lagged behind the others and the gap was significant. The laggard Advanced Micro Devices (AMD). It was the only one, which showed the negative price dynamics for the first ten months of 2017 with a -2.71% loss compared to +104.58% for NVDA, +43.94% for TSM and +14.62% for S&P 500. Continue reading "Chip Maker Hits Target, Beats Rivals and Bitcoin"

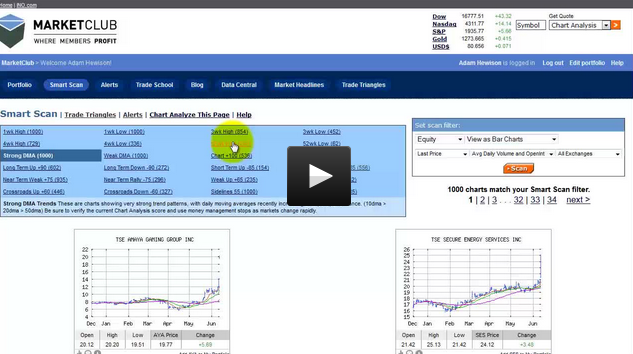

Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your

Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your