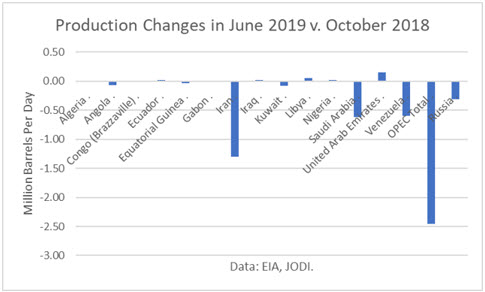

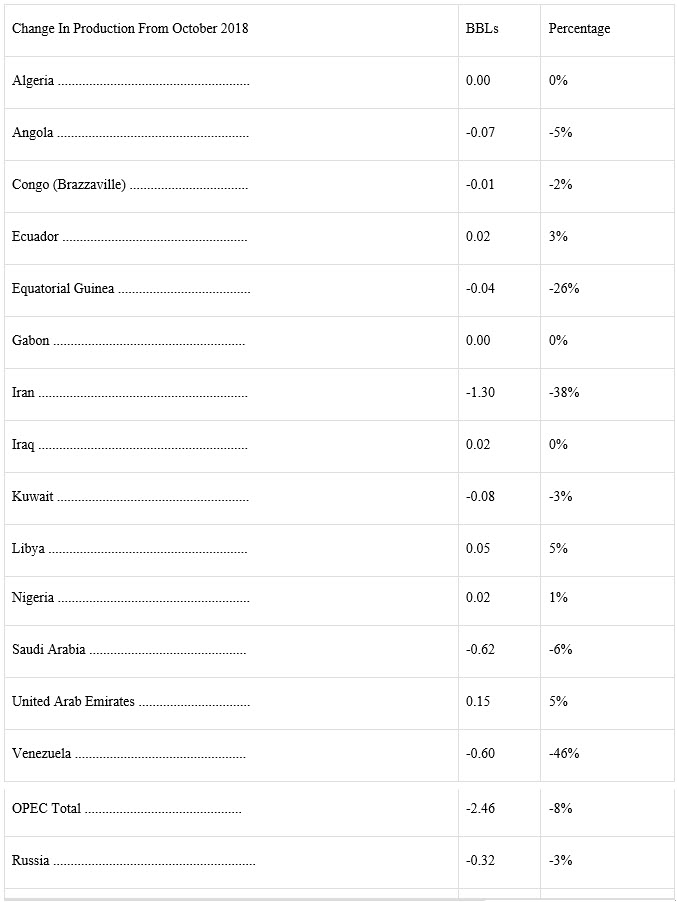

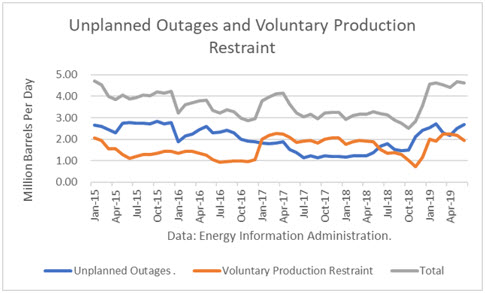

In early July, OPEC+ rolled-over its December 2018 agreement for another nine months ending March 2020. To get an idea of compliance with that agreement to-date, I compared changes in production from October 2018 (the base period) and June 2019, except for Russia, May 2019 due to a lack of data for June.

I found that OPEC delivered a cut of 2.46 million barrels per day, of 8%. That is more than three times its pledge of 800,000 b/d. The primary reason for such a large cut was sanctions on Iran and Venezuela.

Iran reduced its reported output by 1.3 million barrels per day or 38%. Venezuela reduced its output by 600,000 b/d, or 46%. It’s important to understand that both of those cuts were involuntary.

The largest voluntary cut was by Saudi Arabia, 620,000 b/d, or 8%. Saudi Aramco (ARMCO) lifted its production by 200,000 b/d in June from May to 10.1 million barrels per day.

Note: Russia’s change is until May 2019.

Even though OPEC production fell to 29.9 million barrels per day in June 2019, global OECD stocks built by 40 million barrels per day over the first six months of 2019, according to the Energy Information Administration. In addition, June stocks are 97 million barrels higher than a year ago.

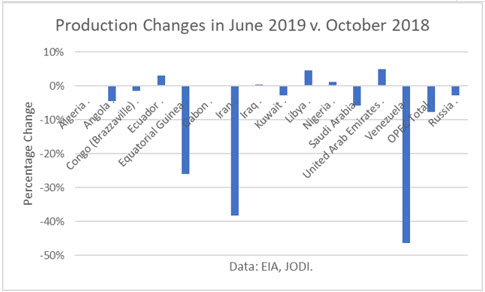

Unplanned Outages

The EIA defines unplanned outages as supply losses that “include, but are not limited to, sanctions, armed conflicts, political disputes, labor actions, natural disasters, and unplanned maintenance. Unplanned outages can be short-lived or last for several years, but as long as the production capacity is not lost, EIA tracks these disruptions as outages rather than lost capacity.”

EIA estimated that unplanned outages totaled 2.69 million barrels per day in June 2019. That is the highest level since December 2015.

Iran’s unplanned outage of 1.7 million barrels per day accounts for 60% of the total. Also included is a 500,000 b/d outage in the Partitioned Neutral Zone Between Saudi Arabia and Kuwait. Production was halted there due to political issues, and there are reports that progress has been to resolve the dispute.

EIA also tracks “Loss of Production Capacity” and “Voluntary Production Restraint.” The former “includes natural capacity declines and declines resulting from irreparable damage that are unlikely to return within one year. This lost capacity cannot contribute to global supply without significant investment and lead time.” For example, EIA considers that PDVSA could not restart much of Venezuela’s oil production soon or with significant investment.

Finally, “Voluntary Production Restraint” is the amount OPEC members withhold from supply due to their efforts to help support prices. EIA estimates that 1.93 million barrels per day were withheld from the market by OPEC.

Challenging First Quarter 2020

The International Energy Agency predicts that the demand for OPEC oil will drop to just 28.0 million barrels per day in 1Q20. Saudi Aramco’s chairman, Khalid Al-Falih, has said it will adjust its production to accommodate shale oil, but that would require an-almost 2 million barrel a day cut to keep stocks from rising.

Saudi Aramco’s production would have to drop to around 8 million barrels per day. And OPEC’s “Voluntary Production Restraint” would have to rise to almost 4 million barrels per day, assuming no changes in “Unplanned Outages” or “Loss of Production Capacity.”

Conclusions

Were it not for Unplanned Outages in Iran and loss of capacity in Venezuela, the OPEC+ cut would have had to be much greater, and perhaps impossibly high. Even so, the outlook through 2020 is going to require restraint that may also be impossible to reach. If somehow an agreement is made between Iran and the U.S. to resolve their differences, and sanctions are removed, the outlook would be dismal for oil prices.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.