It looks like my post titled "Platinum Could Rocket To $1912" published in November 2019 could turn prophetic as the price of platinum price is moving quickly in the direction of the called target. The majority of readers supported this idea at that time, although with a small margin.

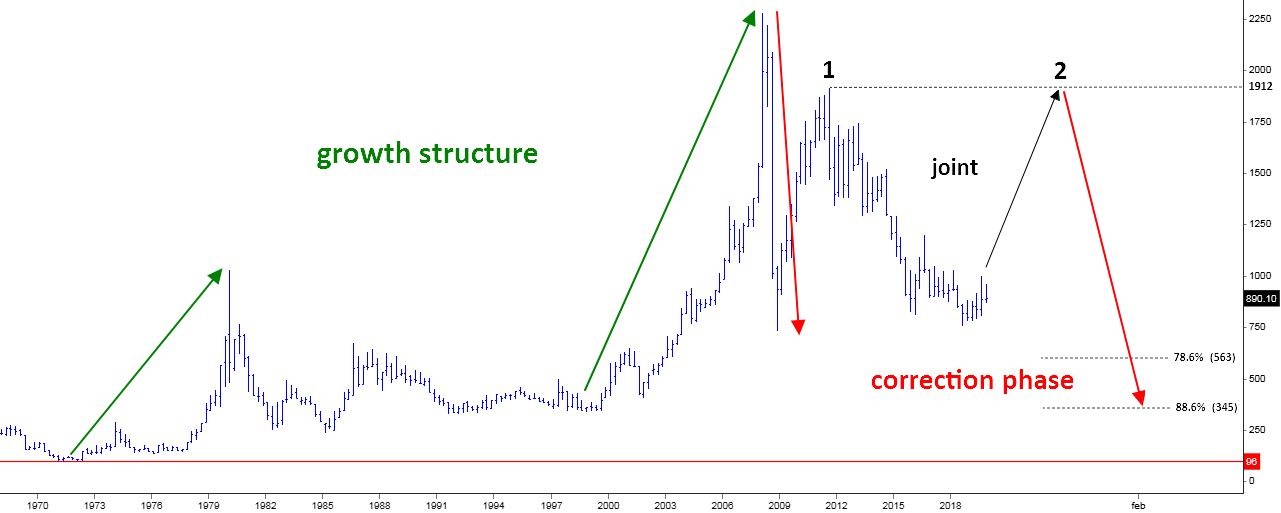

Below is that very chart where I shared the global structure for the large complex correction in the platinum market.

To remind you, the idea was that leg 2 to the upside (black up arrow) should complete the "joint" between large red legs to the downside. It was thought to retest the top of leg 1 above $1900. The price was at $890 then.

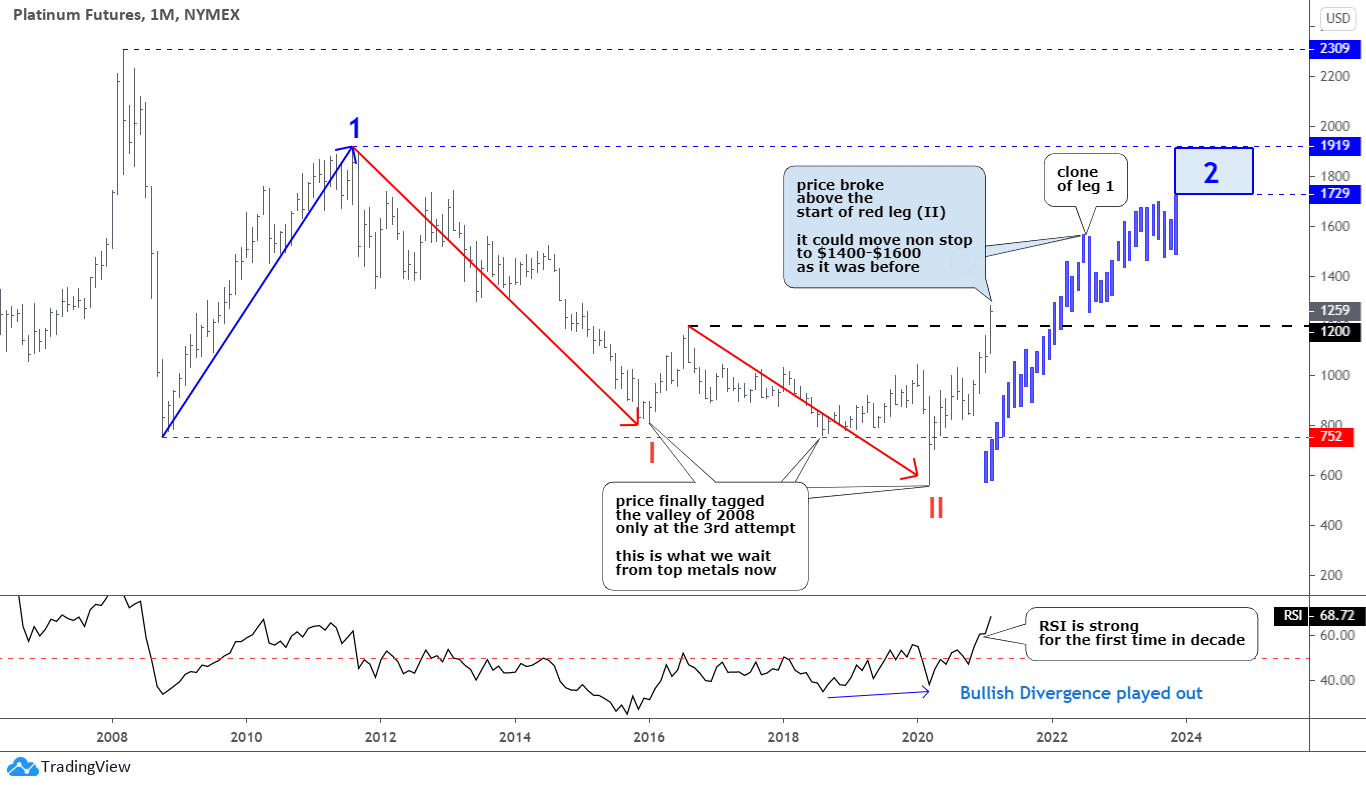

Let us see what happened after that and how the structure looks these days in the monthly chart below.

On the chart above, I focused on the "joint," as you already saw the global structure in the first chart with a quarterly period.

The first move up (blue up arrow) was retraced for more than 100% in two red legs to the downside. The red leg (II) is shorter than the red leg (I) as the former traveled almost 61.8% of the latter. The price finally tagged the valley of 2008 at the third attempt as two previous tries were close but did not reach the goal. This kind of price action we wait in top metals (gold and silver) charts these days to complete the corrective structure.

After four months since my post was published, the idea started to play out as the valley of $562 established last March became a growth point for a possible "runaway train" of platinum.

The crucial bullish trigger of $1200 located at the start of the last red leg down was breached to the upside last week. I put the clone (blue) of the first move up on the right to show you the relative performance and the possible path of the current move to the upside.

We can distinguish the similar behavior of the price in the current trend as we have the same initial move up and the following minor correction after which the price moved sharply higher. We are witnessing it these days as platinum triggered the black dashed horizontal resistance beyond $1200, and the angle keeps quite sharp. As we can see on the clone, further rapid growth is quite possible up to $1400-1600, where the next minor correction could occur.

After the correction mentioned above, the growth pace slows on the clone. The final jump could reach the blue box target area, starting from $1729, where the blue leg 2 would travel an equal distance with the blue leg 1. The top of blue leg 1 of $1919 is the next target. In the very optimistic scenario, the price could even reach the all-time high of $2309 to complete the structure.

Let us look at the RSI; we can clearly spot the textbook Bullish Divergence that appeared between the valleys of 2018 and 2020. It played out perfectly, sending the price to breach the trigger as RSI reached high levels that were not seen for a decade. It is a promising sign.

The price should not drop below $1000 to keep the idea intact. This is the area where the initial move peaked.

The first three options above are clear. I checked platinum-related mining stocks, and among the U.S. traded, there is the Sibanye-Stillwater (SBSW), which is the world's largest primary producer of platinum. I wrote about this company in 2017 when it had the name of Stillwater Mining Company (SWC) before the takeover, considering it to be a good investment. It almost reached an all-time high already as the company is among the top producers of palladium and gold. This exposure buoyed the price before platinum did it and the risk/reward is not so good, though.

Among ETFs, this one is outstanding as it has the largest amount of assets under management of $1.57 billion. The Aberdeen Standard Platinum Shares ETF (PPLT) is designed to track platinum bullion's spot price by holding the bars of the metal in a secured vault of J.P. Morgan Chase Bank, N.A. in London, United Kingdom.

The key drivers for a strong platinum price are the recovering Chinese automobile market and the global carbon neutrality trend. Platinum is the crucial element in producing "green" hydrogen from the water. Hydrogen is gaining momentum as a potential clean energy alternative. This could add up to the deficit of the platinum in the market.

In its first 2021 forecast, the World Platinum Investment Council sees the supply up 17%, demand up 2%, and a third consecutive annual deficit is expected, at -224 thousand oz. Chinese jewelry demand is forecasted to rise for the first time in seven years.

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Thanks for your analysis. Bought PPLT about a year ago and am board the train.

Dear Mr.Berger,

Thank you for a warm feedback.

Good luck with your journey!

Thank you,

Dear cashbox, it’s my pleasure!

Thank you for reading.