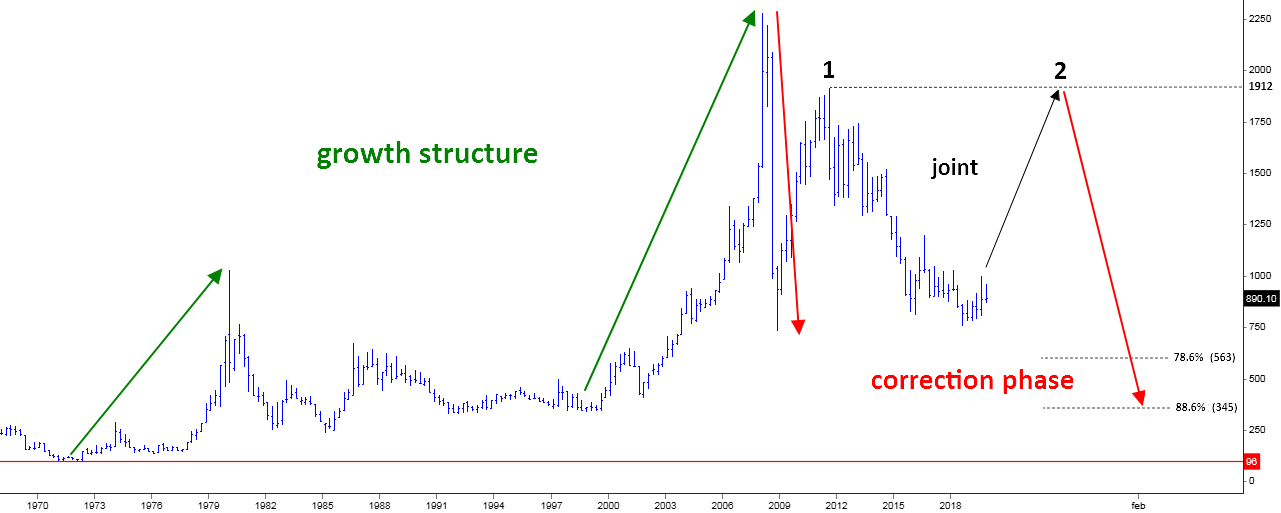

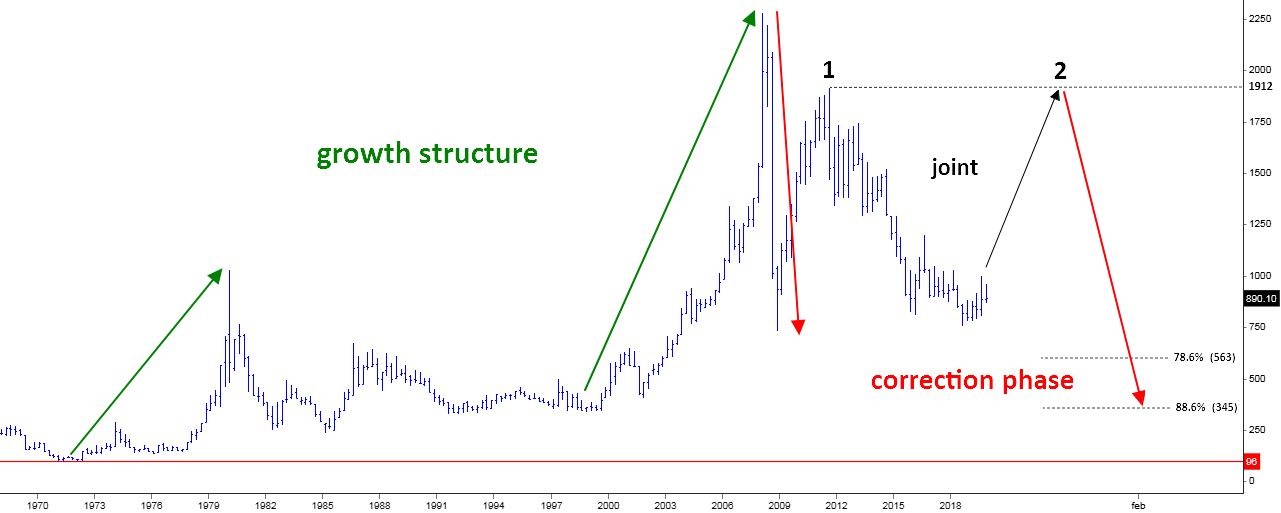

I put the platinum first as it has a clearer structure. The big map has remained unchanged since 2019; I put it down below to brush up.

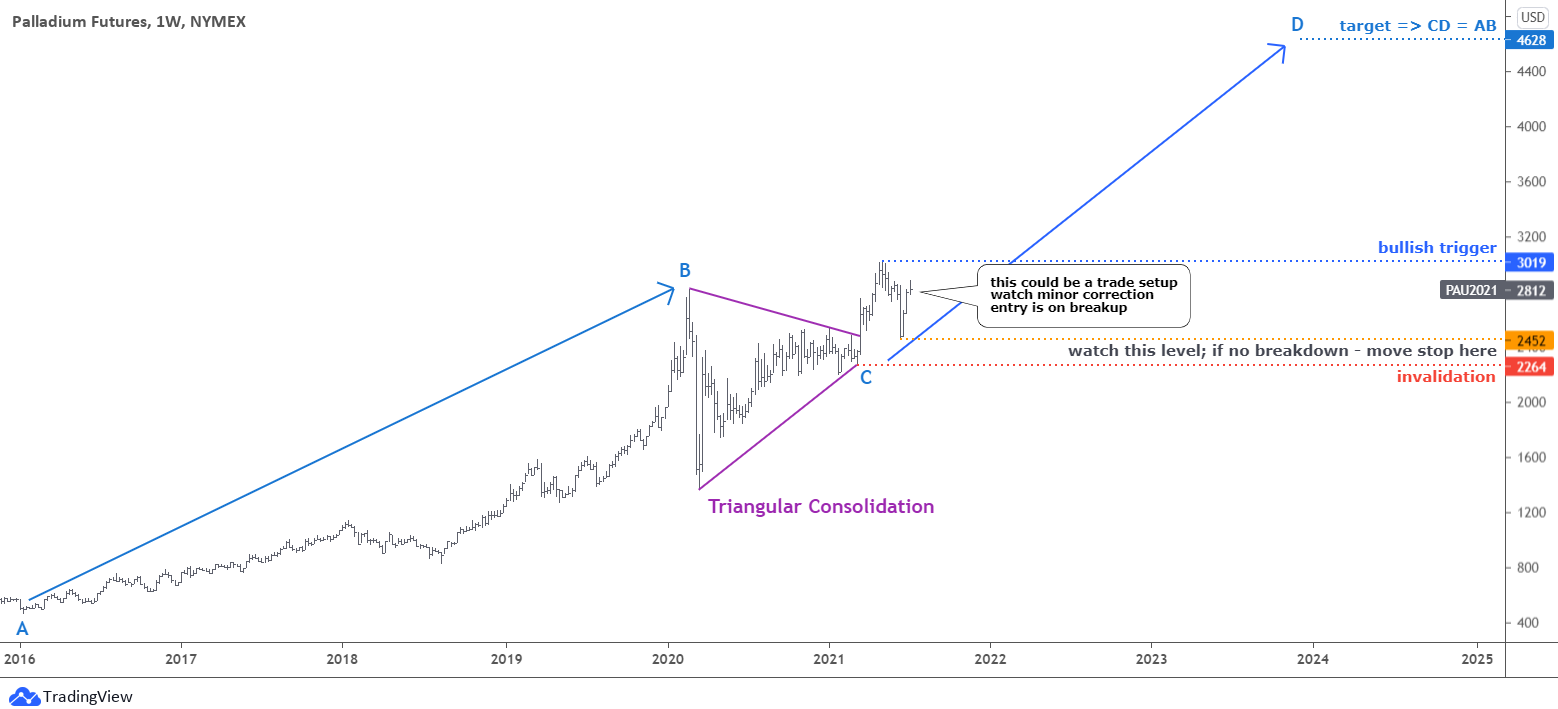

We are in leg 2 (black) with a completed AB part (next chart). I expected the CD part to start earlier. However, the bullish trigger was left untouched and the market collapsed further down.

The third red leg down has hammered the platinum futures price below $1,000 handle to hit the valley in $893. It is amazing how symmetry works here, as all three legs are almost equal to each other. It is a good sign for the platinum as it suffered a lot. Continue reading "Platinum And Palladium Update"