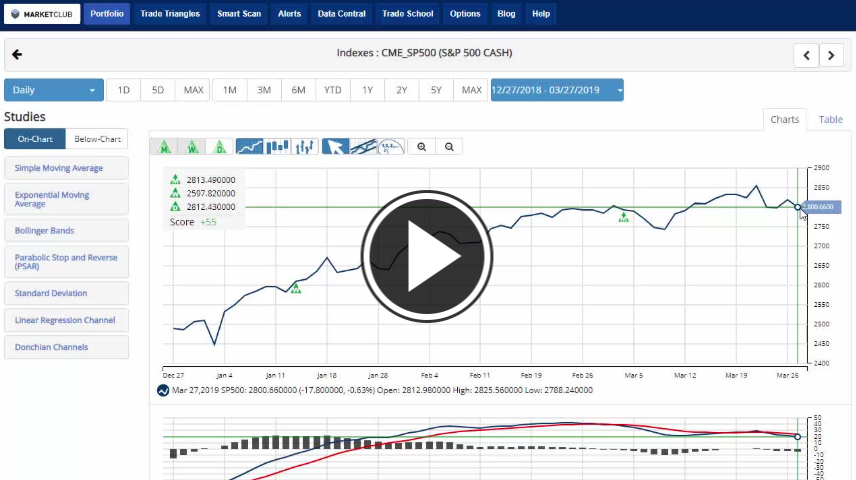

Hello traders everywhere. March was a month of weekly ups and downs with two weeks to the positive and two weeks to the negative, but at the end of the month, the stock market will end in positive territory with the exception of the DOW. In fact, it will close out a strong first quarter to start the year.

Both the NASDAQ and S&P 500 will post monthly gains for +2.4% and +1.54% respectively, meanwhile, the Dow will post a monthly loss of -.3%. On a quarterly level, all the indexes will post gains for the first quarter of 2019. The S&P 500 checks in with a gain of +12%, the Dow +10%, and the NASDAQ will post the biggest quarterly gain of +16%. Quite a start to the year.

After starting off the year slowly losing -.49% in January the U.S. dollar bounced back with consecutive monthly wins gaining +.90% in March. The two winning months pushed the dollar to +1.1% gains for the first quarter of 2019. Continue reading "March Was A Month Of Ups And Downs"