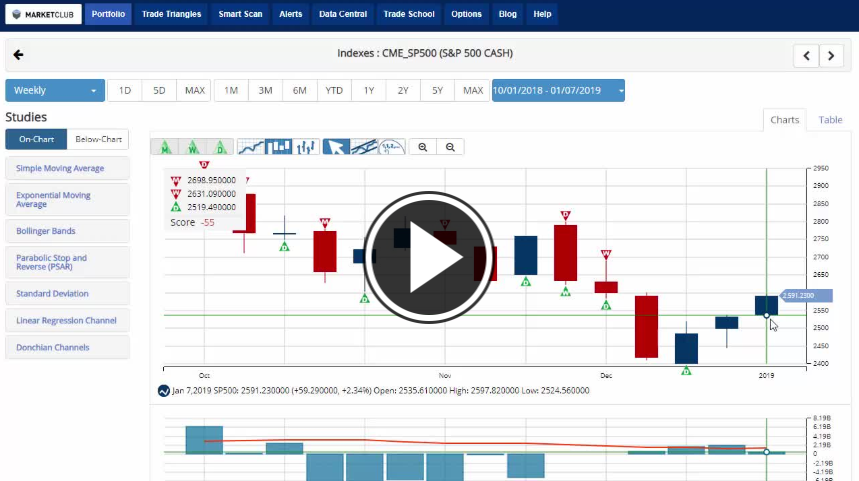

One of my all-time favorite sayings is "money saved is money earned", and I believe that was a great saying to live by this past year, especially towards the end. Like many of you, I was stopped out of almost all of my trades by the Trade Triangles in early October, avoiding devastating losses and living to fight another day. But then there was the flip side, the urge to jump back into some trades. And I can tell that the urge to jump back in the markets is strong amongst our fellow members.

This is where patience comes into play. As I do every day, I followed my game plan and scanned the market because even in a down market there are trades to be made, but I wasn't finding anything that fit my criteria. It's been frustrating, but then I reminded myself to be patient, the market will come back to me at some point. It just so happened that it didn't in October and then I thought of that saying "money saved is money earned," and I didn't feel so bad. After all, I could have pushed and ended up with significant losses.

I know I'm not alone either, I've been talking to our fellow MarketClub members all month answering questions like, "should I change my plan?", "what are you looking at market wise?", "is it ok to trade new weekly Trade Triangles vs. Monthly ones?", "what do you think is going to happen next." I'll take a crack at answering these questions. Continue reading "Patience Is Critical To Your Success"