Hello traders everywhere. What are we waiting for you ask, inflation to pick up steam. The Labor Department announced Friday that the Consumer Price Index edged up 0.1% last month, versus expectations of a 0.2% gain. Traders scour the inflation data looking for clues on the Fed's next monetary policy move. It's going to be hard for the Fed to raise rates with weak inflation.

Market expectations for a December rate hike fell after the CPI data was released. Just 38% of investors expected the central bank to rates again at the end of the year, down from about 45%, according to the CME Group's FedWatch tool.

Do you think they are going to raise rates if inflation remains stagnant?

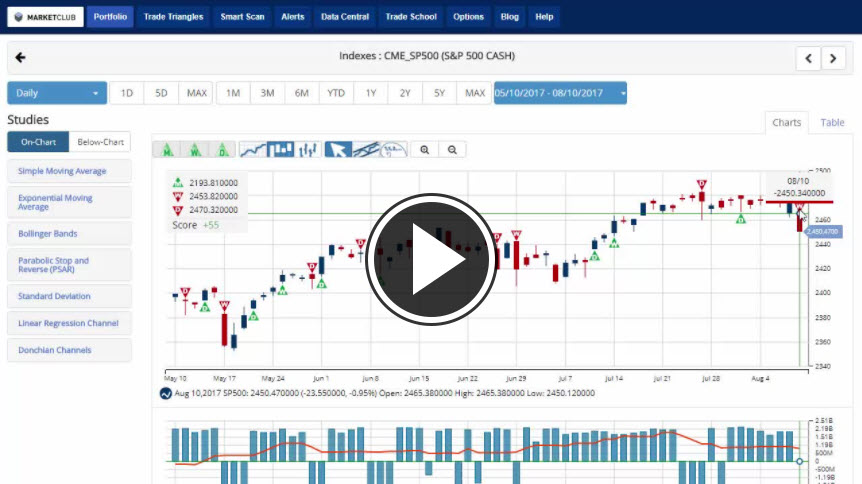

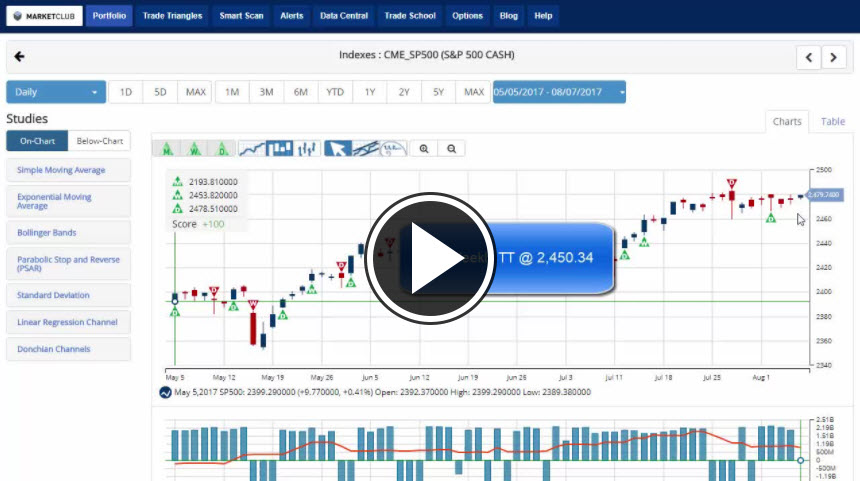

Key levels to watch this week: Continue reading "The Endless Wait Continues"