We've asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

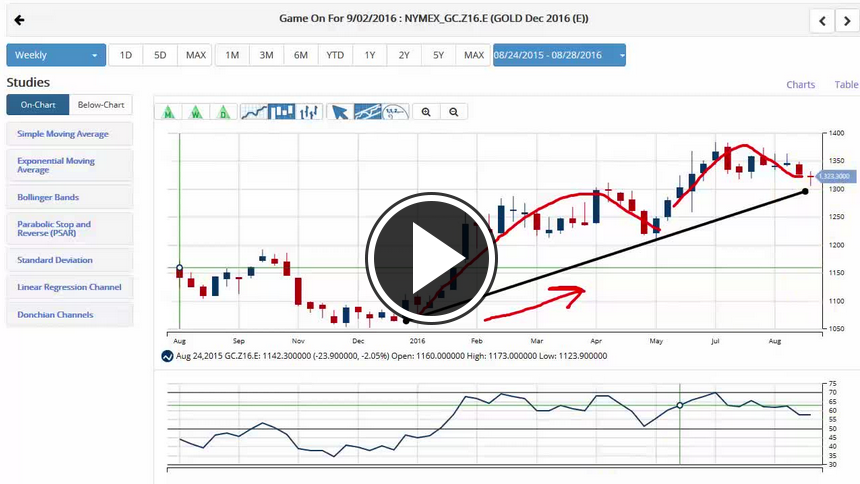

Gold Futures

Gold futures in the December contract settled last Friday in New York at 1,326 an ounce while currently trading at 1,322 down slightly for the trading week. I’ve been recommending a short position from the 1,333 level and then adding more contracts around 1,320 as I still remain bearish while placing my stop loss above the 10-day high which stands at 1,346 as the chart structure has improved tremendously this week. Gold prices have hit 1,306 on 3 different occasions, and if that is broken, I do believe the all-out bear market could get ugly to the downside as prices are still trading below their 20 and 100-day moving average telling you that the trend is lower. Gold prices reacted sharply higher off of the construed negative monthly unemployment report adding 150,000 jobs which were slightly below consensus estimates. However, the U.S dollar has reversed as gold prices were about $17 higher, but currently only up about $5 which happened last Friday as well. The chart structure in gold will not improve for another 5 days, so you’re going to have to accept the monetary risk at this point. Continue reading "Weekly Futures Recap With Mike Seery"