Starbucks Corp Inc. (NASDAQ:SBUX) officially opened a pilot location for the their much-anticipated Green Apron Delivery service today in New York City's Empire State Building. It opens almost a year to the day after CEO, Howard Schultz, announced that Starbucks would be looking into a delivery option, calling it their "version of e-commerce on steroids." It only caters to customers in the building, but will likely serve as the proving ground for future delivery kitchens.

The questions is, will this new pilot service prove worthy of implementation country wide? Will this move propel Starbucks to new heights?

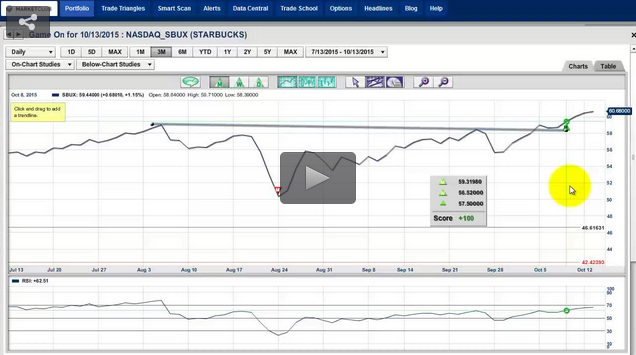

I'll give you my analysis of Starbucks Corp Inc. (NASDAQ:SBUX) in today's video. I will also take a look at gold, the indices and update my thoughts on some other stocks that I mentioned last week.

Stay Strong, Stay Disciplined.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub