Yesterday, we saw the first glimmer of hope from Greece and that was enough to push the markets up sharply and optimism once again ruled the markets.

Today's announcement of a nuclear deal with Iran is a different kettle of fish. I do not view the nuclear deal with Iran in quite the same positive light as the deal with Greece. The ramifications are very different and of course, potentially life-threatening for a very sensitive part of the world.

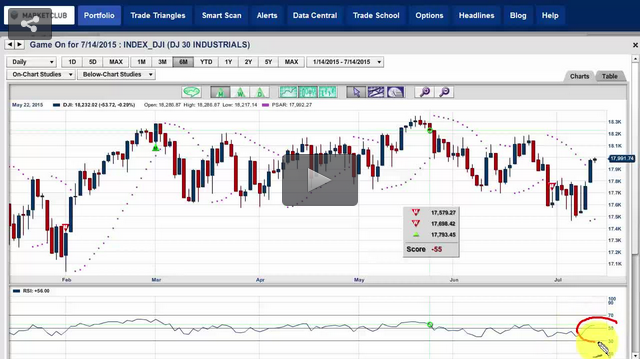

It is going to take the markets some time to digest the ramifications of this deal as it is still way too early and premature to assume either the best or worst scenario for this deal. Putting all that aside, today I'm going to look at the technical aspects of the major indices, crude oil, gold and the euro and time permitting, a couple of stocks that are looking good technically.

Tell us, what do you think of this nuclear deal with Iran? Please feel free to leave your comments below this post. I would be most interested in hearing how you think this will affect the markets, crude oil and of course, the world.

Q3 promises to be a very interesting quarter in many aspects. Q3 happens to be one of the most successful quarters for trading soybeans. You can see all of our soybean entry and exit signals in our World Cup Portfolio, right here.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub