Are you prepared for what could be a wild market ride in 2020?

Nearly 3 out of 4 economists[1] believe that a recession is drawing near.

Here's the big question - do you have the tools to help you spot a crash and still find strong trending markets in a weak market?

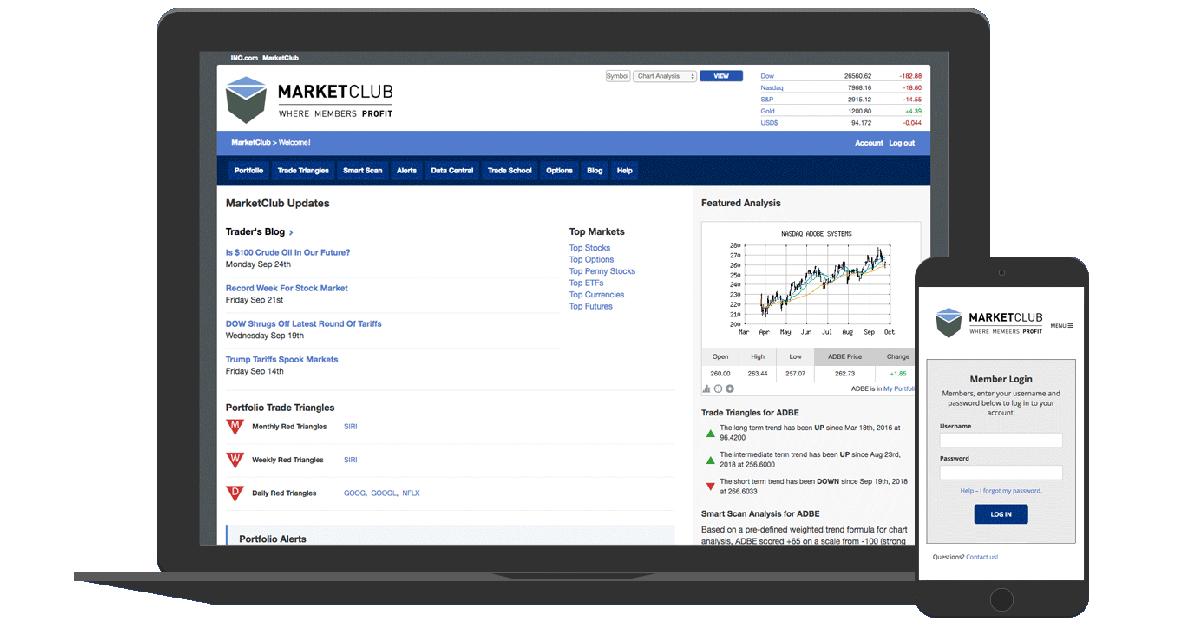

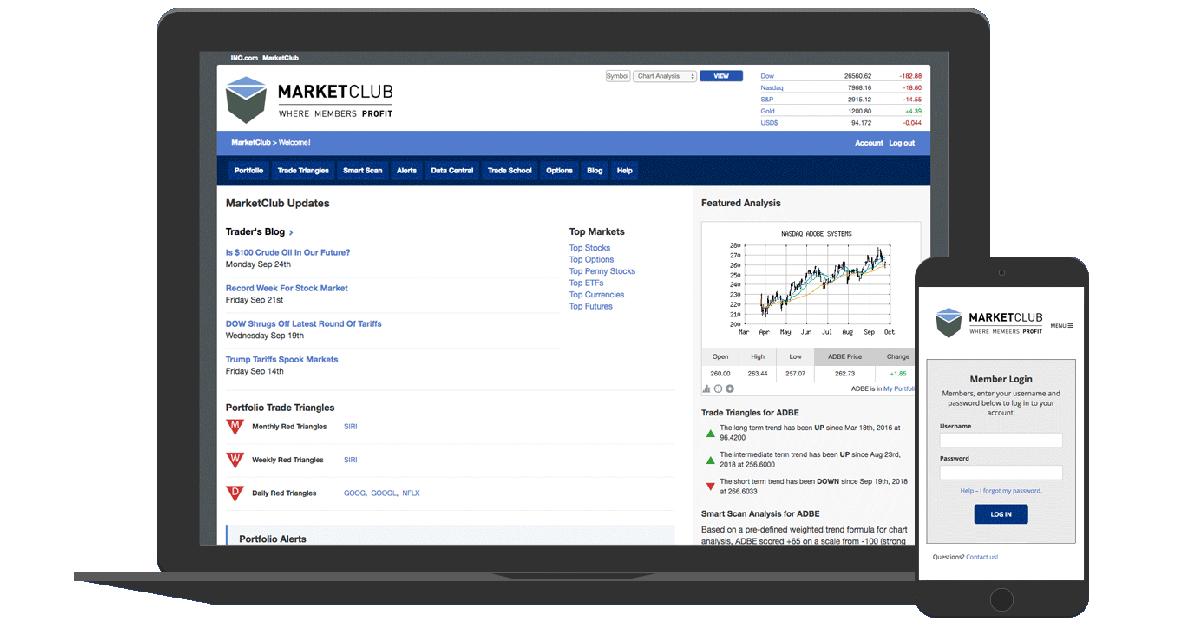

With INO.com's premium service, MarketClub, timing and analyzing your trades has never been easier.

There is no better time to try our tools so you can capture more profits in 2020!

This offer has expired.

You'll have unlimited access to our...

You'll have unlimited access to our...

- Exclusive analysis for 350K+ stocks, futures, forex, ETFs and mutual funds

- Entry and exit signals to guide you through the strongest trend moves

- Top lists highlighting the best trading and investment opportunities

- Customizable charts complete with popular chart studies

- Custom portfolio and strength ratings

- And more...

When you join this month, you'll lock in a 33% discount on your membership rate - and you can keep that discount for the lifetime of your membership!

If for some reason you don't feel like MarketClub is going to help you better find, time, manage your trades, we'll give you a full refund within the first 30-days. No questions asked.

This offer has expired.

If you have any questions or need help signing up, our team would be happy to help.

Sincerely,

Melissa Nuckols

Customer Support Manager, MarketClub

1-800-538-7424 |

su*****@in*.com

[1] Marte, J. (2019, August 19). 3 out of 4 economists predict a U.S. recession by 2021, survey finds. Retrieved from https://www.washingtonpost.com/business/2019/08/19/out-economists-predict-us-recession-by-survey-finds/.

You'll have unlimited access to our...

You'll have unlimited access to our...