Analysis originally distributed on September 27, 2017 By: Michael Vodicka of Cannabis Stock Trades

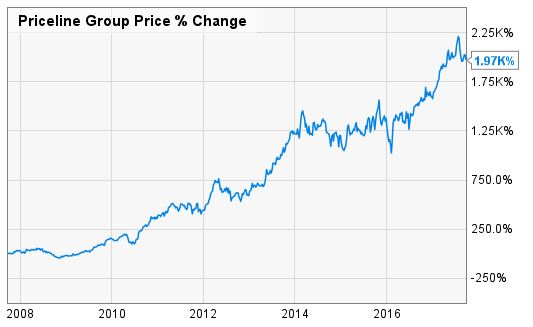

The Priceline Group Inc. (NASDAQ:PCLN) has been one of the best performing stocks in the S&P 500 for the last ten years.

Priceline's gain of 1,970% destroyed the S&P 500's 64% return in the same period. Take a look below.

Investing $1,000 ten years ago would be worth $19,700 today.

Investing $10,000 ten years ago would be worth $197,000.

The reason for Priceline's success is simple. It uses technology to help consumers find great deals.

Today - I see this same cycle repeating itself in the cannabis sector. Continue reading "The Priceline of Cannabis up 213% in 2017 - More to Come?"