We've asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

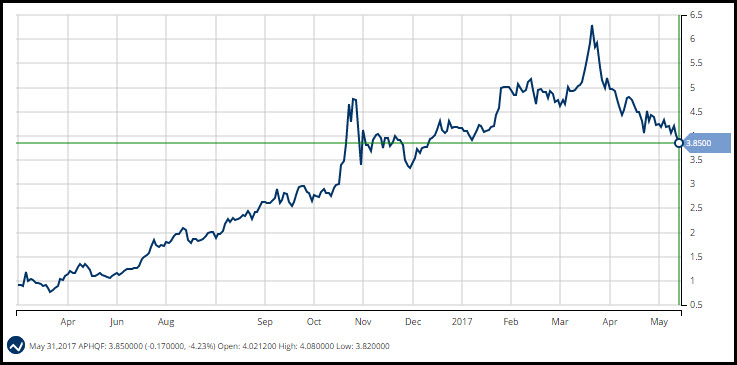

Crude Oil Futures

Crude oil futures settled last Friday in New York at 47.66 a barrel while currently trading at 45.55 down about $2 for the trading week, but still trading under their 20 and 100-day moving average as prices are looking to retest the May 5th low of 44.13 in my opinion. The longer-term and short-term trend is to the downside as large supplies continue to keep a lid on prices. Gasoline and heating oil also continue to move lower, and my only recommendation in the energy sector is short the natural gas market at this time. The chart structure in oil is poor as the 10-day high is around $52 which is over $6 away. I'm currently waiting for the monetary risk to be lowered and I am looking at a short position possibly in next week's trade. There are concerns about gasoline demand which has also pushed oil lower over the last several weeks, but this market has been very choppy in 2017 as the volatility in the commodity markets are starting to rise once again as the summer months are upon us and historically speaking this is when you see large price swings up or down.

TREND: LOWER

CHART STRUCTURE: POOR

Continue reading "Weekly Futures Recap With Mike Seery"