Its no secret that here at MarketClub we are technical traders. We look to the charts to reveal setups and trends that we expect to act a certain way. Technical trading is not for everyone though, that's why we have invited our friends from Benzinga to tell you a bit about trading the news. Enjoy and be sure to visit the Pro's at Benzinga for more insight on trading news.

Its no secret that here at MarketClub we are technical traders. We look to the charts to reveal setups and trends that we expect to act a certain way. Technical trading is not for everyone though, that's why we have invited our friends from Benzinga to tell you a bit about trading the news. Enjoy and be sure to visit the Pro's at Benzinga for more insight on trading news.

Every day, investors from all over the world discuss the prospect of trading on technicals or fundamentals. It is much less common, however, that investors discuss the idea of trading the news. But by doing so, it can provide them with an opportunity for quick intraday gains, as market-moving headlines can make a stock soar or send it plummeting to its death.

Without question, the key to successful headline trading is to receive the news in real-time before the stock has made its move. The news regarding M&As, FDA approvals, increased guidance, or new contracts frequently (and immediately) send shares higher the moment the news is released. On the other hand, key personnel resignations, secondary offerings, and disappointing economic data generally provide profitable short opportunities. The moves can vary anywhere from a few percent points to more than 50% gains or 50% reductions.

Let’s take a closer look at some of the key investing opportunities that can be brought on by breaking news: Continue reading "Using Real-time News to Profit in Today's Unreal Market Conditions"

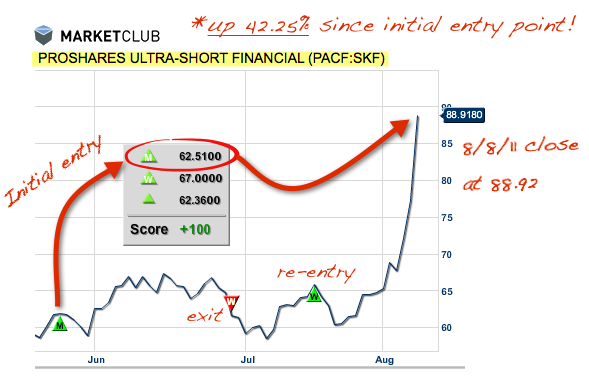

It would almost seem like MarketClub's Trade Triangles could see into the future, but you won't find any mumbo-jumbo or "black box" technique hiding behind our symbols, just market-conquering technical analysis.

It would almost seem like MarketClub's Trade Triangles could see into the future, but you won't find any mumbo-jumbo or "black box" technique hiding behind our symbols, just market-conquering technical analysis.