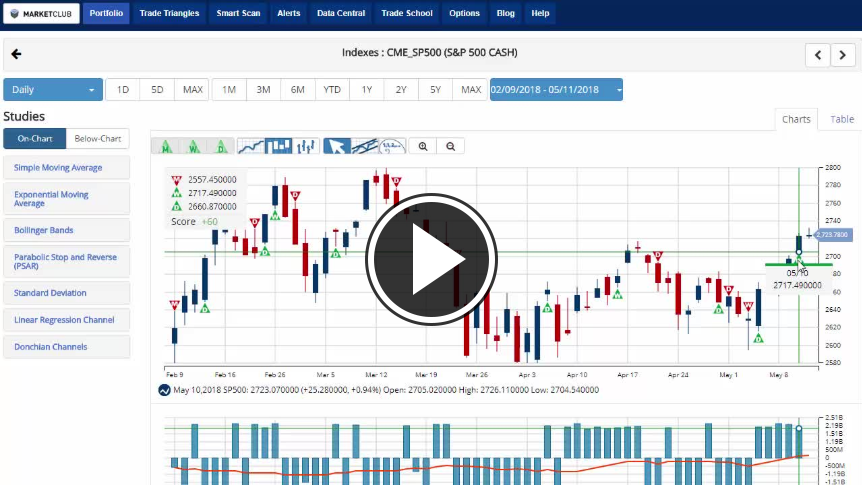

Hello traders everywhere. For the first time in a few weeks, the stocks market is looking to post strong weekly gains. Friday morning kicked off with a bang as all three indexes were posting their strongest weeks since early March, but the push higher didn't last as the afternoon hit. However, it looks like they will all post weekly gains over 2% on the week. The S&P 500 and DOW both triggered new green weekly Trade Triangles on the recent market strength, but both still have red monthly Trade Triangles indicating that the overall long-term trend is still weak.

Is the dollars run over? After posting two weeks of over 1% gains, the dollar is posting its first weekly loss in three weeks with a loss of around -.10%. While it's not a huge loss, it does signal that some weakness has entered the arena after weaker than expected US inflation figures for April were reported.

Crude oil has backed up last weeks gains with a +1.8% gain this week and continuing to trade above the $71 level. The move higher was exacerbated by geopolitical tensions in the Middle East, which caused concerns over potential supply disruptions down the road. Look for oil prices head higher as bulls exploit geopolitics to power the rally, but the question is, for how long?

Gold has jumped higher on the dollars recent weakness. After three straight weeks or significant losses gold is looking to close out the week higher with a +.50% gain. With geopolitical tensions gaining strength and a weakening dollar look for gold to head higher from here potentially.

Bitcoin continues to be trapped in a tight trading range, and it is posting its first weekly loss after four straight weeks of gains with a loss of -11.9%. As I've been highlighting, the 200-day MA is proving to be a tough level of resistance for Bitcoin to break and with this weeks loss the 50-day MA level of support at 8,262.19 is close to being broken to the downside.