Yesterday, the Trade Triangles issued a green weekly Trade Triangle for gold. Gold (FOREX:XAUUSDO) now has three green Trade Triangles indicating that it's ready for the next upward leg in this long-term bull market.

As I have pointed out before, this quarter is the highest-rated quarter with an 83% success rate for gold trades using the Trade Triangles. Let me just be clear that this does not mean that this particular trade is guaranteed to be successful, but the odds are heavily in your favor.

I've added two charts below, a daily chart and a quarterly chart to illustrate the last time gold was in a prolonged bull market. That bull market started in Q1 of 2009 and continued for 11 quarters ending in April 2011. On the quarterly chart, you will see that every quarter for those 11 quarters the market closed higher than the previous quarter. If that same scenario plays out again, gold has 9 quarters to go.

Key To Quarterly Chart

1) The start of the 11-quarter bull market

2) The RSI indicator moves to its highest levels in 3 years

3) Gold is 2 quarters into a long-term bull market

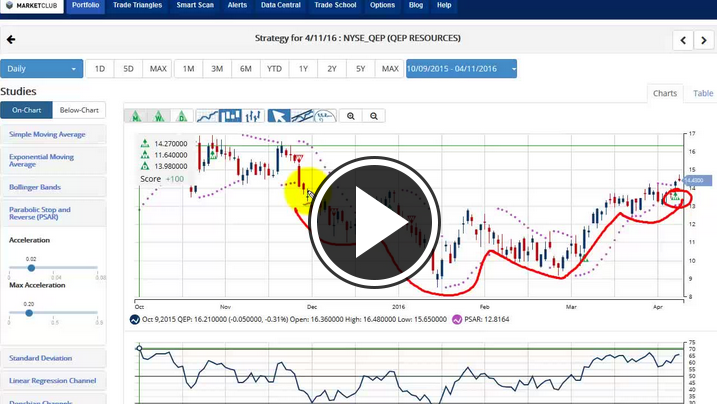

While the quarterly chart gives us a view of the big picture of how gold has acted in the past, the daily chart shows you how to use the Trade Triangles. For intermediate-term trading, you use the weekly Trade Triangle, which we just had a signal with yesterday, as the trend indicator and the daily Trade Triangle for exit and entry signals. If you are a long-term trader, then you want to rely on the monthly Trade Triangle, which has been positive for quite some time. Continue reading "All Aboard The Gold Train"