We were so incredibly fortunate to be told about a wonderful organization doing amazing things in Guatemala. INO.com President and co-founder, Adam Hewison, learned about this mission work from his daughter’s father-in-law, Richard Lusk, who has been participating with Hope For Guatemala for over 3 years.

We were so incredibly fortunate to be told about a wonderful organization doing amazing things in Guatemala. INO.com President and co-founder, Adam Hewison, learned about this mission work from his daughter’s father-in-law, Richard Lusk, who has been participating with Hope For Guatemala for over 3 years.

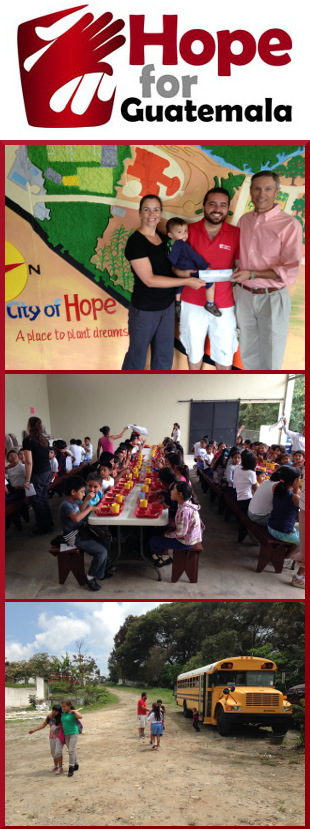

When doing mission work for Hope, Richard Lusk primarily teaches micro-entrepreneurship to the Guatemalan locals with the hopes that they will be able to create and sustain profitable businesses which will remove them from the poverty that is so rampant in Zone 18, the poorest section in Guatemala City.

Hope for Guatemala also provides nutritional breakfast and lunch meals to over 250 children, as well as educational instruction, extracurricular activities and vocational training to over 120 families. Among having farmers donate produce, the organization is also farming and starting a fishery to create a sustainable food source for the families of Zone 18.

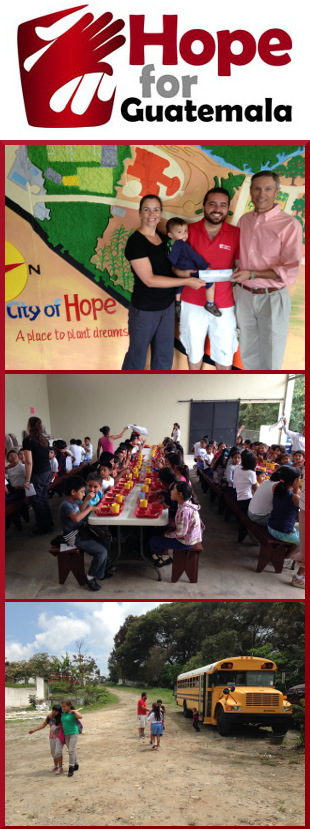

Mr. Lusk was kind enough to hand-deliver an INO Cares check to the founders of Hope For Guatemala during his trip. We selected this amazing organization for the month of August, even though we sent funds a tad early.

Mr. Lusk sent a little note once he returned to the states,

"Adam,

I just returned from Guatemala last night and I wanted to share some pictures of the Hope for Guatemala visit we made. It was a great visit and God's love definitely shows to these little kids that are served by this ministry!!

Jose and Erin Armas (the founders of Hope for Guatemala) were so grateful for your donation. Jose and Erin are about 35 years old. He is from Guatemala City and she is from the US. They have 3 kids of their own. They started Hope about 8 years ago. They feed around 275 kids a day, 2 meals per day, 5 days a week. They also help with school work, learning a skill/craft for the older kids as well as improve their nutrition levels. They have recently acquired a horse, and the reward for good grades is a ride on the horse. They have the only library and computer lab in Zone 18 (the poorest zone in the city).

This funding will help them tremendously and they really appreciate it so much. They make a dollar go sooooo far with their hard work and volunteer staff and the kids are in desperate need of nutrition, teaching and for someone to give them care and love.

Your contribution will help insure that this will continue to happen. It was a pleasure to present them with your donation on your behalf.

Thanks again for thinking of Hope for Guatemala and your generosity.

All the best,

Richard"

Learn more about Hope for Guatemala, how you can contribute or even volunteer! We wish Jose and Erin Armas the best as they continue this important work. Thank you Richard again for taking our donation right to the founders!

Best,

The INO Cares Team