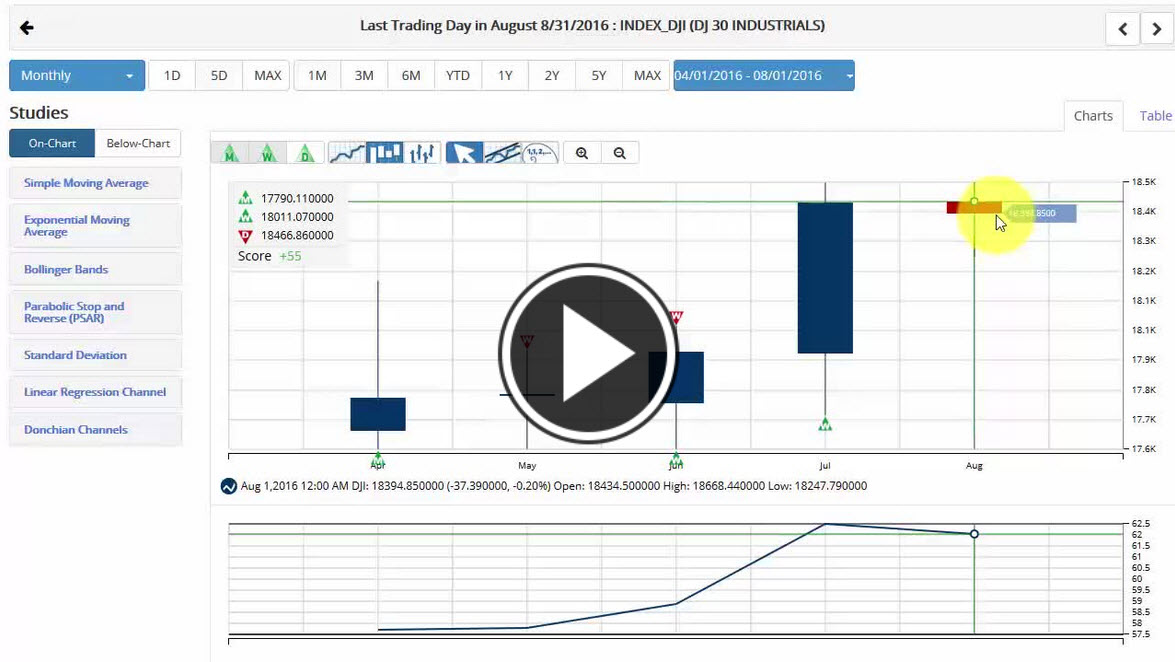

Hello MarketClub members everywhere. There is no doubt about it Friday's move was sharp and painful for many investors. However, if you are following the Trade Triangles you were out of the market and on the sidelines based on the red weekly Trade Triangle's that were indicating potential problems for all the major indices.

Looking back, Friday's move looks very similar to the move we saw on June 24 of this year when the market dropped dramatically on a Friday only to open lower on Monday. The markets then reversed themselves and moved up and made back all their losses in just four or five days.

The big question is, is this going to be a repeat of last June? Continue reading "Haven't We Seen All Of This Before?"