Hello MarketClub members everywhere!

Make no mistake about it; the markets will all be obsessing about whether or not Great Britain will stay or leave the EU.

This morning all the markets are thinking happy thoughts and are rising as they think that Britain is going to stay in the EU.

The bottom line is no one has a clue if Great Britain will stay or leave the EU. The other crazy thing is no one has a clue as to what will happen if Great Britain leaves. As you can see, there is no clear cut path or idea as to what's ahead.

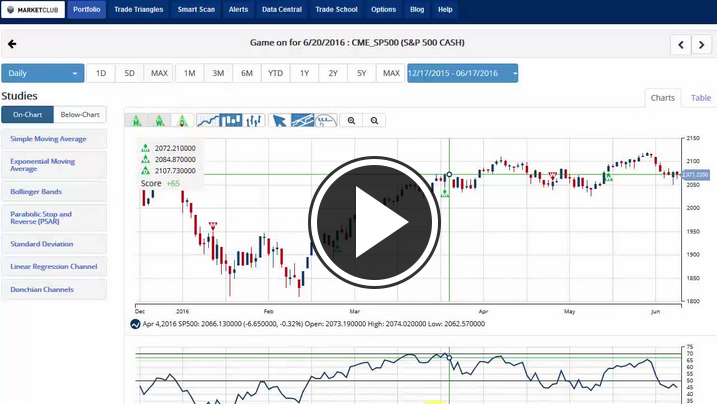

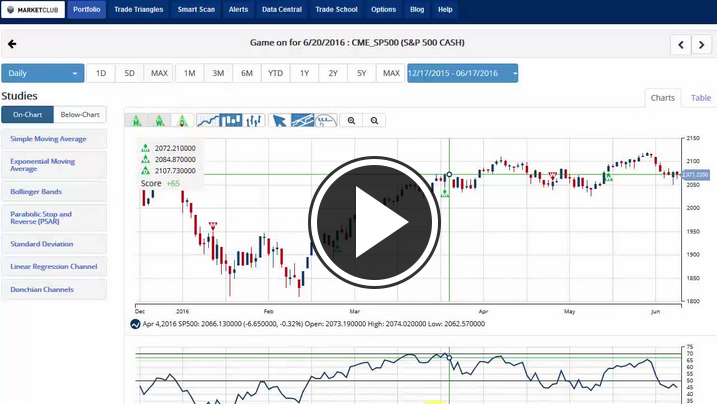

So here is what to do - I call it the "Desert Island" approach to trading. Let's say you were trapped on a desert island with plenty of food and water but with no news of any kind. The only news you could receive is stock and futures prices - could you trade on just that information? Before I answer that question, ask yourself this question, if you were looking back at a stock chart and back testing would you be looking at the news? The answer is probably not, you would be looking at price action and that is exactly what the market proven Trade Triangle's do every day.

The bottom line is price action make market trends.

One caveat - Black Swan Events Continue reading "All Eyes On Brexit" →