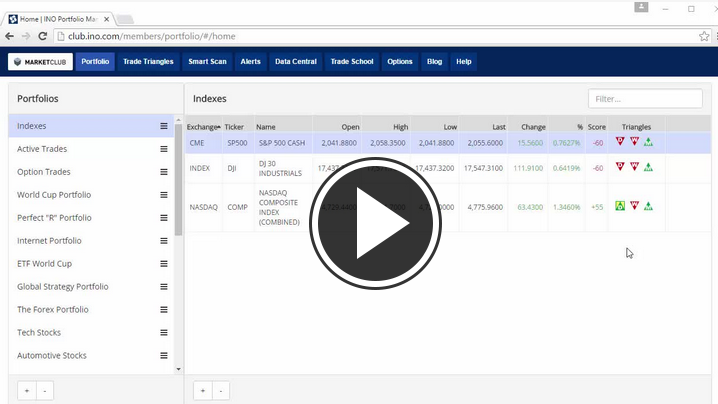

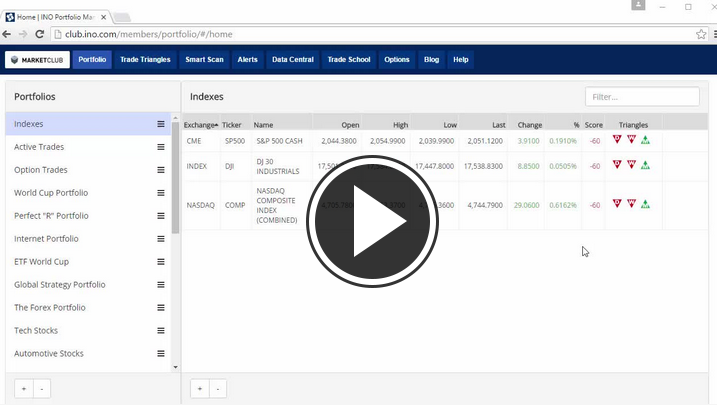

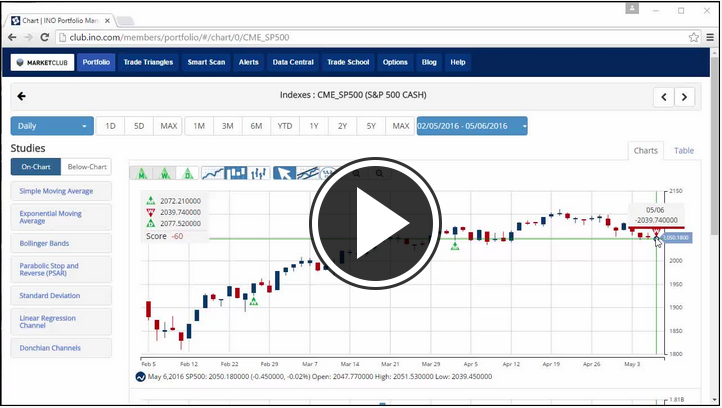

Stocks are on the rise Friday, with the S&P 500 bouncing from a seven-week low. The rise has been led by the technology sector with the NASDAQ gaining 1.35 percent. It also seems that anxiety over the potential interest rate hike by the Federal Reserve as early as next month is starting to wain a bit.

Sales of existing U.S. homes rose more than expected in April, suggesting the economy continues to gather pace during the second quarter. The National Association of REALTORS said on Friday that existing home sales increased 1.7 percent to an annual rate of 5.45 million units. March's sales pace was revised slightly higher to 5.36 million units from the previously reported 5.33 million units.

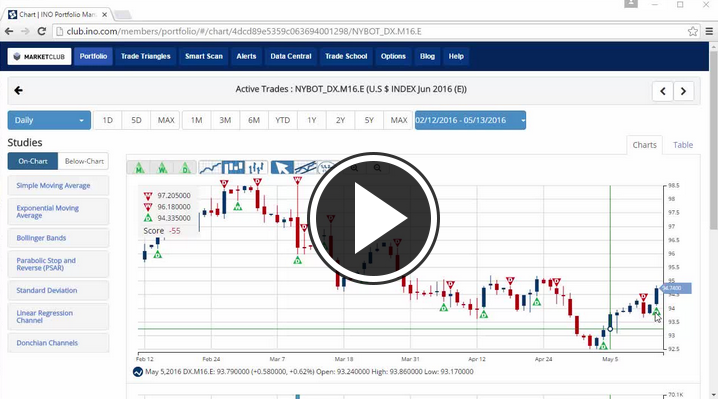

Key levels to watch this week: Continue reading "Fed Rate Anxiety Fades As Existing Home Sales Rise"