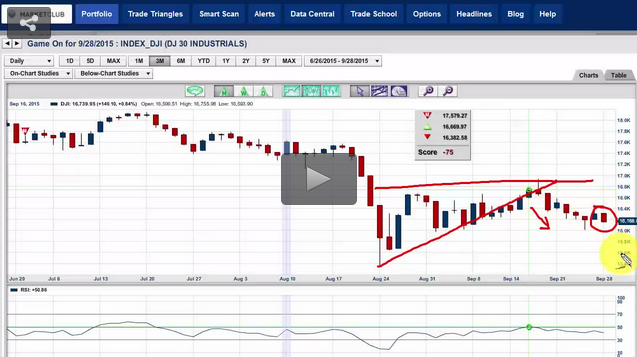

This is turning out to be a very expensive week for investors who are still holding long positions in this market. As I warned late last year and all this year, I felt the market was and is going to be volatile and more than likely going lower.

Let's go back several years to the first quarter of 2009 when the equity markets bottomed out and began their six-year climb to the stars.

If you look at the S&P 500, you can see that it made a low on the week of March 2, 2009 at 683.38. Six years later on the week of July 13th it closed at a high of 2126.64. I want to look at the market using the Fibonacci tool and see potentially where this index might be headed on the downside. A classic 38.2% Fibonacci retracement takes this index back to 1,574, (it closed at 1,921.84 yesterday). A 50% retracement would bring the S&P 500 back down to 1405.51 and a 62% retracement would take it all the way back down to 1236.24.

The S&P 500 closed last Friday at 1922.03 Continue reading "Crude Oil Crashes Through $30 And The Market Follows"