We've asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

Crude Oil Futures

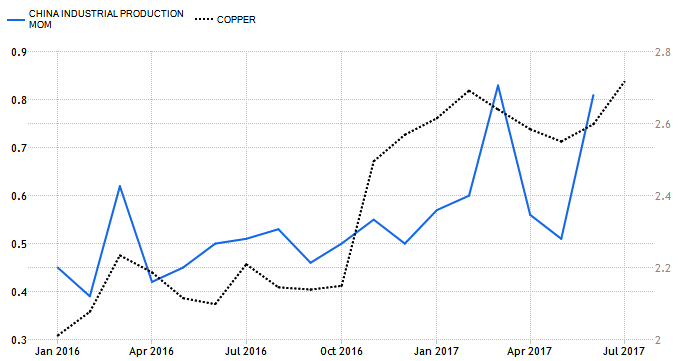

Crude oil futures in the October contract settled last Friday in New York at 48.66 a barrel while currently trading at 47.80 down slightly for the trading week with low volatility despite the fact that Hurricane Harvey could do some severe damage in the state of Texas. Harvey has put tremendous volatility in the heating oil and unleaded gas futures. Oil prices are trading slightly below their 20 and 100-day moving average telling you that short-term trend is lower, but this trend is mixed to sideways with little movement over the last six weeks. I'm currently not involved, and I'm waiting for a breakout to occur which could happen in next weeks trade. I've seen hurricane situations before, and they do spike prices up in the beginning, but then they fade away very quickly. I don't think there will be much damage occurring from the situation, but we will see come Monday but in the meantime look at markets with a better risk/reward scenario as prices are still stuck in a consolidation between 47/50 over the last month or so as a breakout is coming soon. My only recommendation at the present time is a bullish copper position as there are very few strong trends.

TREND: LOWER - MIXED

CHART STRUCTURE: SOLID

Continue reading "Weekly Futures Recap With Mike Seery"