Today, I'm going to be analyzing the stock of BB&T (NYSE:BBT).

BB&T Corporation is a financial holding company. BB&T conducts its business operations primarily through its commercial bank subsidiary, branch bank, and other non-bank subsidiaries.

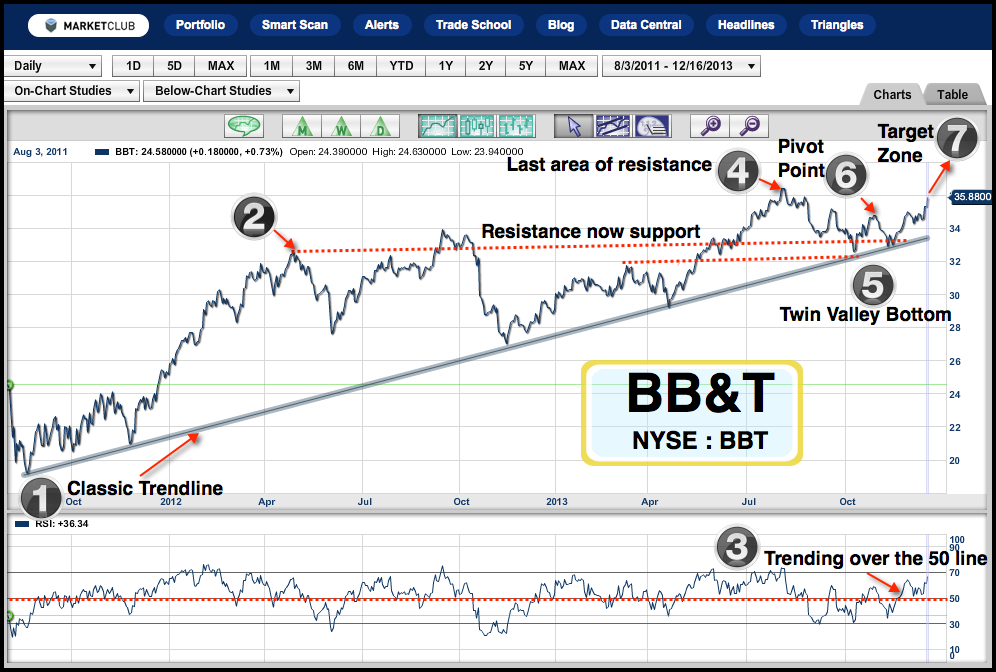

Now that we have the basics of how BB&T operates, let's take a look at the chart. The most outstanding feature to me on this chart is the long term trend line. This trend line touches five price points, making it a very powerful and important trend line in the future.

The RSI is trending over the midpoint 50 line, indicating a strong trend. Plus, all of the Trade Triangles are green and positive. The last major trend Trade Triangle signal was on 12/13/13 at $35.58. Continue reading "On My Radar Today - BB&T (NYSE:BBT)"