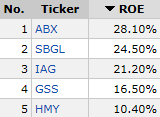

Gold is under pressure after it couldn’t break above the previous major top and the gold stocks couldn’t escape the same fate. Last time I filtered the gold stocks by ROE and in this piece, I would like to make an update on their price performance for you.

To remind you, the top stock tickers are ABX (Barrick Gold), SBGL (Sibanye Gold), IAG (IAMGOLD), GSS (Golden Star) and HMY (Harmony Gold Mining).

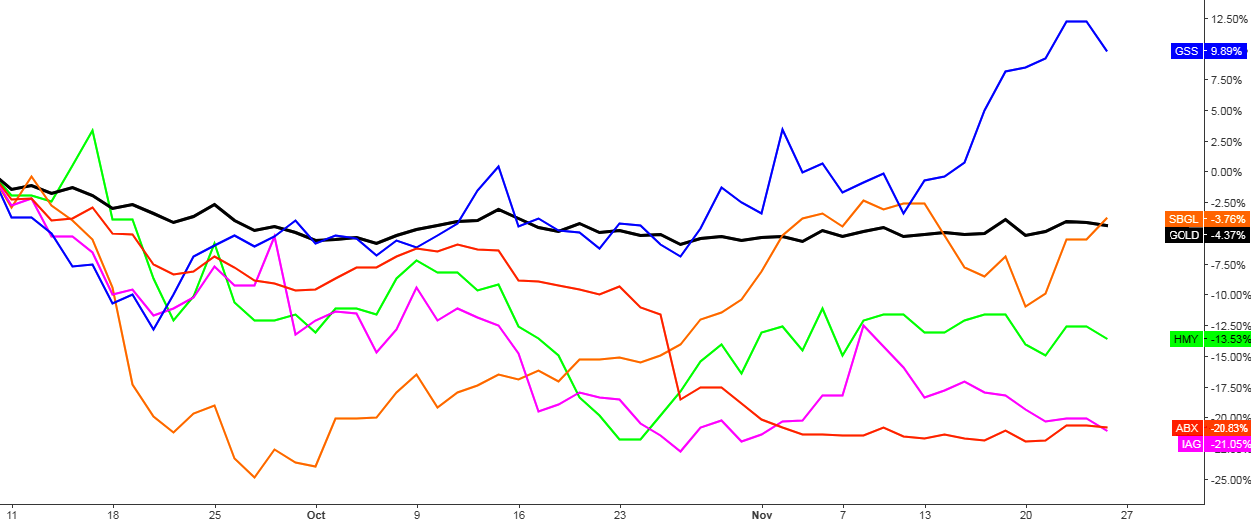

Chart 1. Top Gold Stocks Vs. Gold: The Brightest Star Is The Golden Star

Chart courtesy of tradingview.com

Gold topped on the 8th of September at the $1357 level, and that’s where I have started the chart. Gold (black) lost more than 4% from that peak. Three of the five stocks lost more in price than gold did: HMY (green) fell for more than 13%, your favorite (see chart #3) ABX (red) dropped almost 21%, and the worst performer is IAG (purple) with -21% drop, which was the top gainer in the previous update. Continue reading "Gold Stocks Are Under Pressure Except For One"