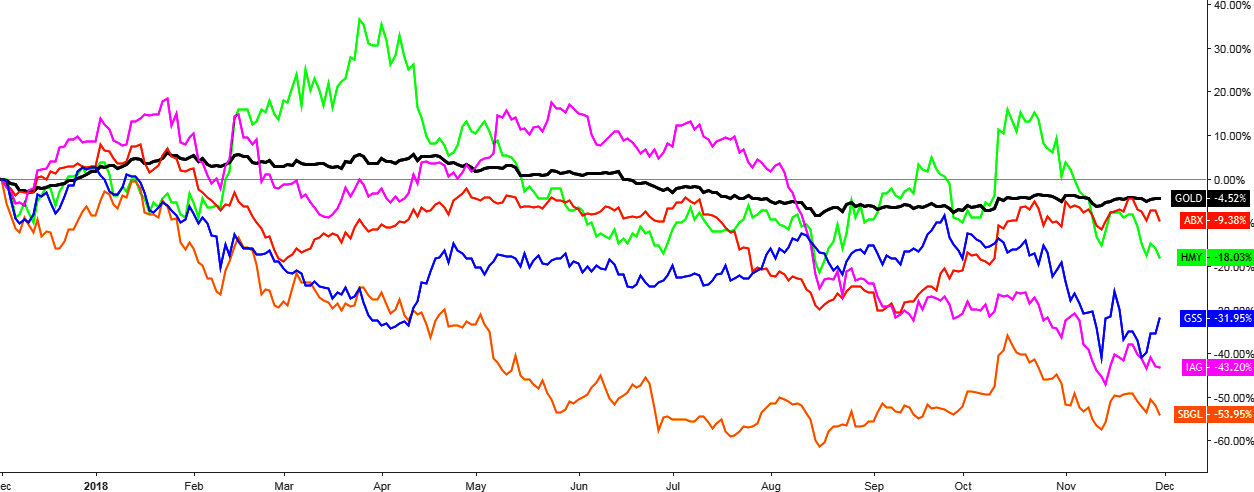

While the Nasdaq 100 (QQQ) has continued its outperformance on the back of a strong start to the Q1 Earnings Season for Big Tech, the real outperformer has been the Gold Miners Index (GDX).

Not only is the index outperforming the major market averages with a 17% return but it’s also outperforming the price of gold, a healthy sign that suggests a potential change in character after years of underperformance.

The recent strength can be attributed to the sharp rise in the gold price towards the psychological $2,000/oz level, resulting in significant margin recovery for gold producers after a tough year plagued with supply chain headwinds and inflationary pressures.

The good news regarding the recent rally in the Gold Miners Index is that momentum is to the upside and sharp pullbacks are likely to find buying support.

The bad news? With the index up over 50% from its Q3 2022 lows, some of the easy money has been made and a few miners are actually looking fully valued.

Fortunately, there are exceptions, and in this update we’ll look at two names that look reasonably valued and are likely to outperform given their relative value compared to peers.

Marathon Gold (MGDPF)

Marathon Gold (MGDPF) is a development-stage gold company based out of Newfoundland, Canada, with the company currently busy constructing its Valentine Gold Project.

The project is home to nearly 3.0 million ounces of gold reserves and the company plans to operate an open-pit mine consisting of three pits (Berry, Valentine, Leprechaun) with average annual production of 195,000 ounces of gold (first 12 years) at industry-leading all-in sustaining costs of $1,007/oz.

Based on the current schedule, Marathon is aiming to start producing gold by year-end 2024, and the project should boast ~48% margins and generate $120 million per annum in free cash flow at a $1,950/oz gold price. Continue reading "2 Gold Stocks Likely To Outperform"