Among the big four Eurozone economies, i.e. Germany, France, Spain and Italy, it’s clear which two are the growth drivers. Of the others, that is Spain and Italy; Italy was considered to be the more stable. Spain’s bonds were deemed riskier and its banking sector weaker. But that is a thing of the past. As it stands today, Italy has overtaken Spain to become the weakest link among the Eurozone’s largest economies, with a banking sector desperately in need of a bailout. And if Italy’s banking crisis is a rerun of Spain’s, we can certainly expect some troubles in the Eurozone and, consequently, for the Euro.

Spain vs. Italy in Two Charts

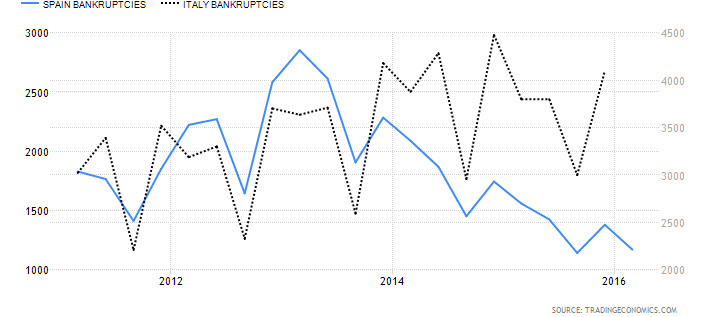

When we compare data on the Italian economy vs. the Spanish economy, we can see an interesting picture emerging. When we examine the trend in bankruptcies filed for both economies, it’s clear that both countries had relatively the same trend in bankruptcies until very recently. Bankruptcies in Italy have started to surge while bankruptcies in Spain have been decreasing.

Chart courtesy of Tradingeconomics

In the bond markets of the two countries, a clear divergence is occurring. Credit Default Swaps for Spain and Italy, which had moved in tandem in the past (with higher risk premiums for Spain), started to diverge back in 2014. Credit Default Swaps for Italy are now much higher. Continue reading "Italy Overtakes Spain As Weakest Link"