Certainly this first trading week in August has been none too kind to the markets. In fact, every major index is lower for the week, along with crude oil, gold and the euro! Not a particularly good start to August as the "death cross" creeps closer to execution. More on that next week.

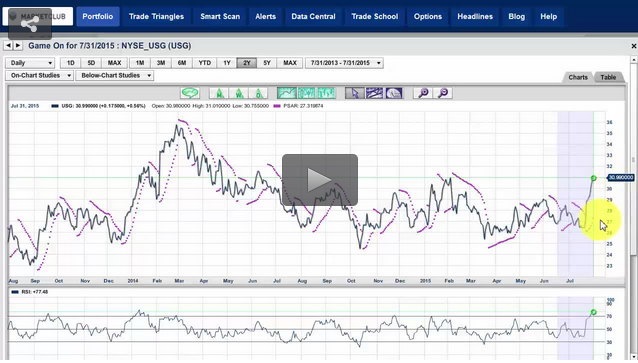

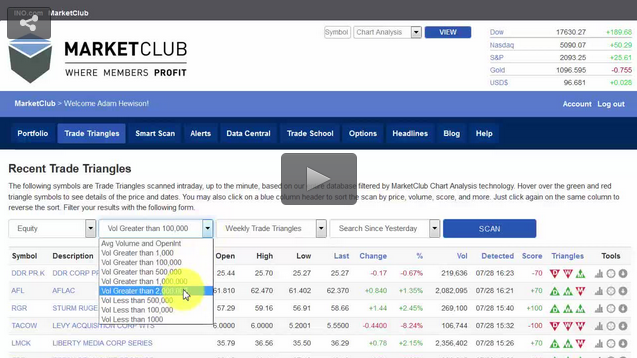

The good news is there's always markets that are bucking the trend and today I'm going to be looking at three stocks that gave buy signals yesterday despite the drubbing that stocks took.

The first stock that I'm going to be looking at is American Tower Corporation (NYSE:AMT). American Tower Corporation is a real estate investment trust. It invests in real estate markets across the globe. The firm engages in leasing of space on multi-tenant communications sites to wireless service providers, radio and television broadcast companies, wireless data and data providers, government agencies and municipalities and tenants in a number of other industries. American Tower Corporation was founded in 1995 and is headquartered in Boston, Massachusetts.

The next stock is Continue reading "3 Stocks That Avoided Yesterday's Downturn And Deserve Your Attention"